By Josh Brandon

Despite high demand for housing in Winnipeg, some new non-profit housing projects are having difficulties filling some of their suites. Housing that has been officially designated as “affordable” is sitting vacant. Frontline housing advocates are rightly concerned.

The last five years have seen a welcome flurry of new publicly subsidized housing construction in Manitoba. Since 2009, the Selinger government has planned 1500 new social housing spaces and an equal amount of affordable housing has been built or is under construction. A second round of commitments will build a further 500 units of each over the next three years.

Social housing spaces are provided on a rent-geared-to-income (RGI) basis making them available to families with low incomes. For example, a family requiring a three bedroom would be eligible with an income below $47,000 per year. Rents are capped at a level 25 to 27 percent of household income. These new units have been widely applauded by anti-poverty advocates and housing providers across Manitoba.

The second leg of the program, providing affordable housing is less well understood. The goal is to make rental housing available to individuals and families with moderate incomes, not eligible for social housing. However, the roll out and implementation of this program in some cases is based on assumptions that create challenges for non-profit housing providers leaving them with units that are hard to rent. So long as suites sit vacant, they do not benefit renters of any income group. If this is not resolved, it could undermine the financial sustainability of some otherwise successful social housing projects in Manitoba.

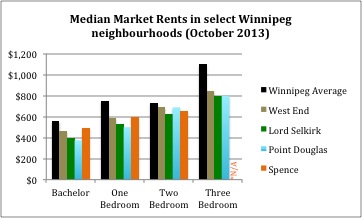

The Province defines affordable housing as housing that is priced at median market rent (MMR) or below. This means that for a given apartment size half are more and half are less expensive than the MMR. In Winnipeg, for a three bedroom the 2014 rate is set at $1,179, including utilities. Given their tight rental markets with consistently low vacancy rates, the MMR has climbed in Winnipeg and other Manitoba cities considerably in recent years making it less affordable to working families.

The logic of the affordable housing program is to make rental housing available to families with moderate incomes. There has been deterioration in the amount of rental housing available in many cities across Canada. After 1992, Winnipeg lost 5,000 units of rental housing, partly to condo conversions, partly to older stock being torn down or amalgamated into larger units. Even with recent new construction, the number of privately owned rental suites has not kept pace with population growth.

The primary growth sector for rental housing across Canada has been in the luxury market. It is easier and more profitable for developers to build for and to market to executives looking for a downtown pied-à-terre than to working parents needing a home in which to raise their families. This developers’ preference is reflected in vacancy rates that correlate inversely with affordability. The cheapest quartile of apartments in Winnipeg has a vacancy rate of only 0.9 percent while the most expensive quartile has a vacancy rate of 3.9 percent. For apartments with three or more bedrooms, the differential is even starker: 0.4 percent compared to 4.5 percent.

The Province is supporting the creation of affordable housing through a variety of programs and subsidies. For example, the Rental Housing Construction Tax Credit provides a rebate on PST for new projects that include at least 10 percent affordable housing. Other subsidies have gone directly to help with capital construction on new developments either combined with social housing or market rental units.

Only households below certain income thresholds are eligible for affordable housing. Currently, the threshold is set at $64,829 for families with children and below $48,622 for households without children. This makes it complementary with the RGI Social Housing program: as a family’s income rises above the threshold allowed for social housing, it becomes eligible for affordable housing. At current rates, this would keep housing costs between 22 and 30 percent of income within the income brackets that are targeted by the program. When affordable housing is working well, it provides multiple benefits stimulating rental construction, providing housing for households with moderate incomes and limiting core housing need.

The following chart shows how income can affect eligibility for various housing support programs in Manitoba. Families with low incomes are eligible for social housing, or if they are in nonsubsidized housing, they may be eligible for a rent top up of up to $270 through Rent Assist reducing their effective rent. Families with moderate incomes may be eligible for affordable housing, while families with higher incomes can expect to pay full market rent, which in many cases will be significantly higher than the median. Currently, rents below $1,435 per month are regulated by rent control. Rent levels on this chart are based on the guidelines of various programs, and do not necessarily reflect the actual rents individual households pay.

Problems with the affordable housing program arise partly from the ongoing need for more RGI social housing. There continues to be excess demand from households with very low incomes. Manitoba’s current social housing boom comes on the heels of a long hiatus of public housing construction across Canada. In the early 1990s, the federal government handed over responsibility for housing to the provinces, with little funding attached. Over that time very little new social housing was built. Recently, the federal government has begun phasing out supports for the social housing that already exists. For households who cannot get into social housing, there are few options in the private market for rent they can afford. For families with very low incomes, affordable housing at the posted rates is patently unaffordable, even with Rent Assist top ups.

Many low-income families choose neighbourhoods where housing costs are at least within reach of affordability. Apartment costs vary considerably across the city. A three bedroom rents for under $850 in the West End, Point Douglas or some inner city neighbourhoods. In Fort Garry, the MMR for a three bedroom is $1400. Using the city-wide median, based at $1179, to calculate affordable housing rent belies the fact that given the locations of many new affordable housing projects, they are among the more expensive suites in their neighbourhoods.

This discrepancy is placing some non-profit housing providers in a financial dilemma. Several recently completed housing projects combine social and affordable housing. Demand for their RGI units was immediate, but they have struggled to fill the affordable units. The types of households they are attracting do not have the resources to rents set at the city-wide MMR, especially when other apartments in their neighbourhoods are renting at up to $300 per month less than MMR. These new non-profit housing developments cannot afford to rent at less than MMR, but cannot afford to keep their suites empty either. Unless a solution is found, this could jeopardize the ability of these projects to maintain quality housing for families.

Thanks to recent provincial investments, many innovative social projects in Manitoba are just starting up. They should be given the opportunity to flourish. Instead, by tying the provision of social housing to affordable housing that may be overpriced to the local market conditions, their financial viability is threatened. Over the long term, more social housing is needed, so that all families needing supports are lifted out of core housing need. In the meantime, inner city non-profit housing organizations supporting affordable housing should be provided with funding to at least bring down their affordable rents to reflect neighbourhood market conditions based on local MMR, not the city-wide average.

Josh Brandon is a housing researcher with CCPA-MB.