Previously published in the Winnipeg Free Press February 28, 2025

The upcoming Manitoba budget should prepare for the economic uncertainty created by U.S. tariffs by building resilience in the local economy and upholding Manitoba’s values of care for each other and the land. The Manitoba government already has a head start by committing to ending chronic homelessness, improving healthcare staffing and the Affordable Energy Plan.

But amid the recent Trumpian chaos, Manitoba must take bold action to insulate our province from emerging risks.

The playing field has changed as U.S. President Donald Trump’s tariff threats create uncertainty intended to compel manufacturing companies and jobs to relocate from Canada to the U.S.

The assumption that free trade would be the road to economic growth has been disproven as the American government protects their interests above others.

The silver lining here? This is an opportunity to accelerate a Manitoba-made, clean and green economy to preserve our ways of life — our health, economic prosperity, and our natural world.

The 2025/26 Manitoba budget should build resilience so that Manitoba can prepare for these changes. The Manitoba government’s role in this is to do more than advocate for the needs of local businesses and corporations. The Manitoba government must lead the creation of a resilient local economy and province.

This starts by helping those currently suffering, which will, in turn, help our local economy. In Manitoba, 56,642 people rely wholly on frozen provincial welfare rates and struggle to survive. 171,072 more Manitobans are working for less than a living wage in Manitoba. If the incomes of these two groups were raised, the money they would spend in the local economy on food and other necessities would stimulate Manitoba’s GDP from the bottom up.

The recently launched Manitoba “buy local” campaign relies on the logic that consumers, not employers, create jobs. Manitoba must raise the wage and income floor to help low-paid consumers buy more. This is a win-win-win: it helps low-income people and local businesses while acting on the impacts of poverty on the provincial health-care and justice systems.

Improving the incomes of the lowest-wage people also strengthens the social safety net in the unfortunate case of more Manitobans losing their jobs.

Secondly, Manitoba must address the infrastructure deficit while preparing for climate change. The Association of Manitoba Municipalities estimates Manitoba’s infrastructure deficit to be over $11 billion — and this is just what’s required to fix existing infrastructure, not to build new.

Fixing public roads, transit, housing, and recreation facilities is an opportunity to create decent local jobs and improve quality of life.

A priority in local infrastructure is acting quickly to electrify Manitoba’s building heating, transit, and transportation systems. This will keep the money spent on energy in Manitoba rather than buying from big oil and gas companies from out of province.

Manitobans must not forget last year’s shutdown of Manitoba’s main gasoline, diesel and jet fuel line for three months. If this had not been caught, there could have been a massive oil spill, and Manitobans left scrambling for fuel.

The Manitoba government needs a long-term plan to get us off these dirty fossil fuels and onto Manitoba-generated electricity, which is more reliable and efficient than polluting, imported energy. The Manitoba Affordable Energy Plan, which includes wind and solar, is a start, but Manitoba needs to commit investment dollars and build on this plan to cut fossil fuel use by half by 2030 and to net zero by 2050.

This requires public investment to reskill workers and provide education, training and apprenticeships to meet the demand for green jobs of tomorrow. Manitoba is well positioned to build on green technology and be ready to share this in the global green energy race.

Supporting local also means public investment in the care economy: health care, child care and education. All of these are important to small businesses and social enterprises for a healthy, educated workforce so they may develop and thrive.

As an agrarian economy, Manitoba must do more to support local food and locally owned agriculture to protect against the tariff threat. Thanks to the new universal school nutrition program, there’s an opportunity to drive this via more local, healthy food to be procured for children to enable health and learning.

To ensure tax fairness and sufficient revenues for investment in local economic development, Manitoba should look closely at who has gained or lost purchasing power over the last few years of high inflation. The Parliamentary Budget Office found the top 60 per cent of households across Canada have more disposable income today than in 2019, while the bottom 40 per cent are further underwater due to inflation.

In Manitoba, top earners also received massive tax cuts due to changes in education property and income taxes. Manitoba’s tax revenues range from the lowest to average amongst provinces in terms of revenue relative to the size of our economy. There is space to modestly and progressively increase tax rates for those whose incomes have increased significantly.

The large deficit in Manitoba and the unprecedented uncertainty in the U.S. means Manitoba must extend the timeline to return the budget to balance. The series of tax cuts introduced since 2016 have created a structural deficit. Faced with U.S. threats, making investments that build resilience and maintain growth will provide greater benefits than balancing the budget in two years.

The Manitoba budget should look at what the Manitoba government can do: build a strong social safety net and provide opportunities for social mobility while building the local, green economy and resilience. Manitoba must rise to this challenge and help each other now and for generations to come.

Molly McCracken is the Manitoba director of the Canadian Centre for Policy Alternatives.

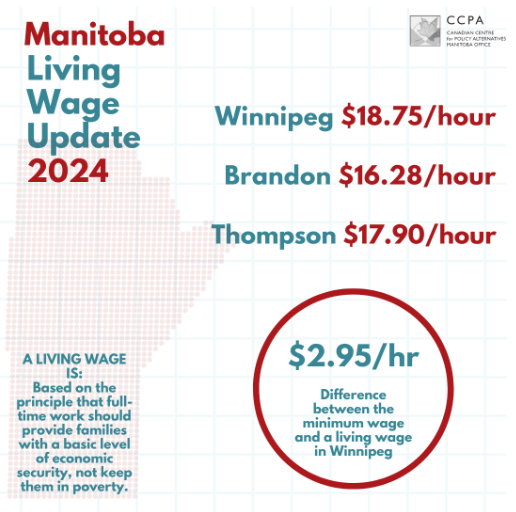

Living wage impacted by significant increase in government income supports

The 2024 living wage for Winnipeg is $18.75 per hour. In Brandon it is $16.28 per hour, and in Thompson it is $17.90 per hour. The living wage is the hourly rate at which a family with two parents working full-time, and two children can meet its basic needs once government transfers have been added to the family’s income and deductions have been subtracted.

The expansion of targeted, indexed government transfers to low-wage families played a central role in this year’s living wage changes. For the Winnipeg living wage family, government transfers increased by 16% while household costs increased by 2%. Food price inflation remained high at nearly 8 percent in 2023, however the price of other large expenses such as child care, and transportation remained stable or decreased slightly. Stabilizing prices, higher government support, and a significant raise in Manitoba’s Basic Personal Amount in 2023 have created a situation where the living wage has decreased slightly for some Manitoba families. Read full report here.

December 17, 2024

For Immediate Release (Winnipeg, Treaty One):

Manitoba’s Second Quarter Fiscal Update makes clear that the provincial government must reopen the conversation on provincial revenue and progressive taxation.

The ongoing large deficit means the Manitoba government cannot sustain the tax cuts introduced under the Pallister/Stefanson government. It must reverse or amend these measures, including the increase to the Basic Personal Amount and tax bracket increases, to provide sufficient revenue not only to fix healthcare but also to address the housing crisis, provide quality public services and fight the climate crisis.

Yesterday, the Manitoba government released its second quarter fiscal update, which announced that the 2024/2025 deficit is projected to be $1.309 billion. While the deficit is projected to decrease from $1.9 billion the previous year, the large deficit is leaving the provincial government with few resources to invest in pressing areas such as social housing development, poverty reduction and food insecurity in Manitoba.

Previously published in the Winnipeg Free Press December 16, 2024

By Dr. Andrew Lodge

Althea waits in line at a local food bank in Winnipeg. Her youngest son, less than six months old, is bundled up asleep in a stroller and she holds her two-year-old in her arms. Nearby, her oldest son, now four, plays with a toy car.

Neoliberalism has led to a growing gap between the rich and the rest of us during a time of climate crisis.

This has led to many compounding crises – a polycrisis – while our collective toolkit and solidarity necessary to act together has rarely been weaker.

This talk focuses on how our views of government, debt, inflation – and, above all taxes – have made us doubt that we can do great things together. And it will explore what it might take for things to turn.

Himelfarb is the author of the new book “Breaking Free of Neoliberalism: Canada’s Challenge” (Lorimer Publishing). The book explains why neoliberalism – idealizing free-market capitalism persists and what can be done to take dramatic action on issues like inequality and global warming. This event doubles as the Winnipeg book launch.

Himelfarb is a former senior clerk of the Privy Council, Ambassador to Italy, Director of the Glendon School of Public and International Affairs, founder of the Canadian Alliance to End Homelessness, and chair of the Canadian Centre for Policy Alternatives.

Jesse Hajer is an Associate Professor in Economics and Labour Studies at the University of Manitoba. He is the co-editor of Austerity in Manitoba: Public Service in Tough Times: Working Under Austerity in Manitoba, 2016-2022.

The 2024 Errol Black Chair in Labour Issues Honouree: The Women’s Health Clinic

With reproductive rights being a central issue in the upcoming US election, the work of the Women’s Health Clinic (WHC) in Manitoba highlights the fragility of the hard-fought gains in women’s reproductive rights and freedoms. Right here at home, women and gender-diverse individuals still have a long way to go to fully realize these rights and freedoms. Thankfully, the WHC has a strong track record of advocating for and making progress on these human rights. It is our hope that by shining a light on the Women’s Health Clinic and those who work there, CCPA can help support and accelerate the achievement of these goals.

Women’s Health Clinic is being honoured at the 2024 Errol Black Chair in Labour Issues event Nov 3, 2024

For Immediate Release (Winnipeg, Treaty One): The Canadian Centre for Policy Alternatives – Manitoba is proud to be honouring the Women’s Health Clinic at their annual Errol Black Chair in Labour Issues fundraising brunch on Sunday, November 3rd, 2024 at 10:00 am at the Fairmont Hotel.

Women’s Health Clinic (WHC) is an intersectional feminist community health clinic with a deep history of activism in Manitoba. With an extraordinary record of serving women, girls, transgender, Two-Spirit, and non-binary people in our community for over 40 years, WHC continues to offer a range of sexual and reproductive health, mental health, and family support programs and services.

As well as serving often-marginalized people with essential services, WHC has a long history of social justice advocacy to influence health policy and practice and community care within Manitoba and beyond. Achievements include supporting the regulation of midwifery in Manitoba, establishing Ode’imin – Canada’s first stand-alone birth centre, and providing much-needed community access to abortion care and eating disorders prevention, treatment and recovery across the province.

The keynote speaker at the fundraising brunch in 2024 is researcher Katherine Scott and the title of her talk is “Still in Recovery: Assessing the pandemic’s impact on women in Manitoba”.

Katherine Scott is a Senior Researcher with the Canadian Centre for Policy Alternatives National office and serves as the director for its gender equality public policy work. She has worked in the community sector as a researcher, writer and advocate over the past 30 years, writing on issues from poverty and inequality to income security reform to funding for nonprofits. She was the lead researcher of The CCPA Gender Gap Index and Beyond Recovery project, which aims to help spur a national conversation about the challenges that women and gender-diverse people face and the progressive alternatives that are on offer at a local, provincial or national level.

Event details

Sunday November 3*, 2023

10 a.m.

Fairmont Hotel, 2 Lombard Place

*Please note daylight savings time ends on November 3rd, 2024 at 2 am.

Tickets on sale now!

Sponsorship opportunities available, please contact molly@policyalternatives.ca

About the Errol Black Chair in Labour Issues

Errol Black was a dedicated activist, leader, economist and Brandon City Councillor who fought tirelessly for social justice. When Errol passed away in 2012, a research chair was created to continue his legacy at CCPA Manitoba. Every fall, we honour a Manitoban who has demonstrated leadership in advancing the rights of citizens and positively influenced the political landscape of our province.

About the Canadian Centre for Policy Alternatives

The Canadian Centre for Policy Alternatives is a non-profit charitable research institute active nationally since 1980 and in Manitoba since 1997. www.policyalternatives.ca

By Molly McCracken and Jim Silver

Previously published in the Winnipeg Free Press October 31, 2024

The cumulative impact of decades of regressive tax cuts has created the severe social, economic, and environmental problems seen daily in Manitoba. Tax cuts are not free money. They take dollars from the public realm where they would otherwise have been invested in health, education, and other essential public goods. Yet corporate and wealthy interests continue to lobby governments for more and more tax cuts.

Follow us!