- Who earns a minimum wage in Manitoba?

- What are the benefits to a $15 minimum wage in Manitoba?

The benefits of gradually phasing in a $15 minimum wage would be far-reaching:

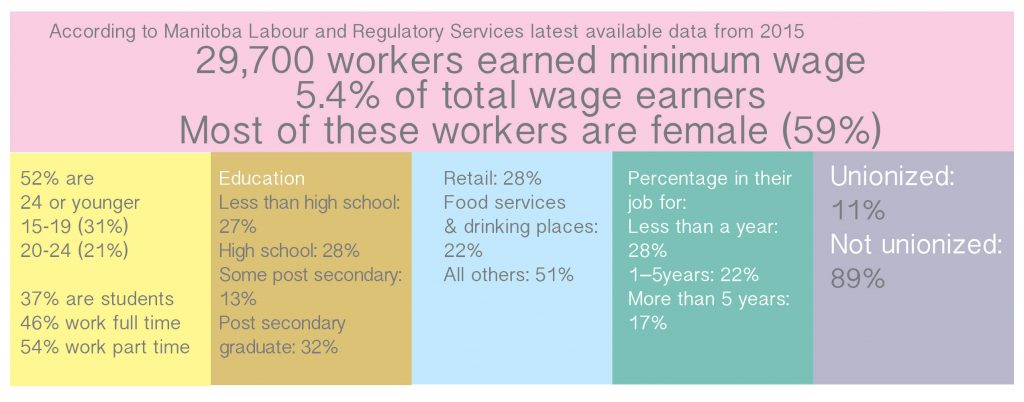

- The 5.4% of workers who earn minimum wage would benefit, plus the 13.1% of workers who earn 10% above minimum wage, for a total of at least 18.5% of workers

- A full time workers’ pay would increase by $7,000/ year before tax.

Women are more likely to work part-time, care for children and parents and work in low-wage industries, which makes them more likely to earn less than $15 / hour and benefit from an increase.

Younger workers are more likely to be working for lower wages as they have less experience, less education and more likely to be working part-time while in school. David MacDonald found 90% of those aged 15 – 19 and 54% of those aged 20 – 24 would see a raise with a $15 minimum wage in Ontario[i].

Recent immigrants would benefit from an increase to the minimum wage, MacDonald found in Ontario one third of recent immigrants would see an increase in wages[ii].

Recent immigrant women in particular would benefit, with 42% seeing a wage increase to a $15 minimum wage, based on Ontario as an example[iii].

Indigenous and racialized workers are more likely to be in low wage work and would benefit from an increase in minimum wage, although more research would need to be done to find out exactly how many would benefit.

Boost spending in the economy: more wages in the hands of workers means they spend more in the local economy. Higher wages feed back into stronger demand and more jobs. Minimum wage earners spend in the local economy on basic goods and services, not abroad on foreign holidays.

Household spending drives 56% of gross domestic product[iv], the majority of economic development. Businesses benefit from more spending.

Income inequality is rising in Manitoba: the lowest 20% of earners are making less market income now than in the 1970s[v]. Increasing the minimum wage to $15 is an important step to reverse this trend.

- How would an increase in the minimum wage effect workers who earn 10% above?

72,100 Manitobans earn minimum wage up to 10% above (13.1% of all workers). The profile of these workers is very similar to those of minimum wage workers.

An increase to the wage floor means usually an increase to those closest to the wage floor, those closest to minimum wage.

When Ontario increased the minimum wage from $11.60 to $14/ hour, many employees increased the wages of those close to the $14 minimum[vi].

For some workers close to minimum wage, particularly those who are unionized, wages can be tied to the minimum wage. If minimum wages go up, unions can use this as a bargaining point for workers they represent who are 10% above.

- What is the impact of increasing the minimum wage to $15 for employers?

Increasing the minimum wage impacts all businesses who rely on a low-wage business model. They will adjust to an increased labour cost. Change is a constant in business.

A phased-in approach to increasing the minimum wage through pre-announced steps to $15/ hour helps business by creating predictability.

Increasing wages reduces employee turn-over, which is costly as employers spend to hire and train people, and when people leave, expertise is lost[vii]. Additionally a higher minimum wage may lead to more on the job training as businesses seek to invest in and retain workers.

When Ontario increased its minimum wage to $14/ hour, Walmart said that all employees’ wages would be increased ‘across the payband’ and no jobs or performance increases would be lost[viii].

- Does increasing the minimum wage to $15/ hour result in job losses?

Minimum wage studies show that raising the minimum wage boosts incomes for low income workers with only a small adverse impact on employment for teenagers.

A Canadian Centre for Policy Alternatives study of all provincial minimum wages and employment changes from 1983 – 2012 found no consistent evidence that minimum wage affects employment levels[ix]. The study found employment, job loss and creation, is determined by larger economic factors, not minimum wage policy.

Two leading American “meta-studies” that look at dozens of minimum wage studies show that minimum wage increases have little or no effect on employment levels or job growth[x]. When the minimum wage is increased other opportunities open up as there is more purchasing power to drive demand.

In 2011 British Columbia increased the minimum wage by 28 percent to catch up for past inaction. This increase did not result in job losses for adult minimum wage earners.

Claims that jobs are lost by business lobbyists or right-leaning think tanks are not credible. David Green showed that studies being used by these groups are using are out dated and based on data from the 1990s or earlier during a recession[xi]. Ian Hussey writes that Alberta’s service sector added jobs despite being in a recession[xii]. Hussey explains that business and their think tanks conflate the impact on all workers based on the employment effects for teenagers when the job losses for adult workers is effectively zero[xiii].

A small proportion of teenagers are impacted:

In BC when the minimum wage was increased a large amount those 15 to 24 saw employment decline slightly by 1.6 percent[xiv]. Interestingly over the same time period the number of young people age 15 to 24 who became students increased by 1.1 percent[xv]. Likely young minimum wage earners returned to school, which improves their earnings in the long run.

- What is the impact of minimum wage on small businesses?

Most people who earn minimum wage work for large companies. Businesses with 500 or more employees employ 41% of minimum wage workers the most minimum wage workers in Manitoba. Businesses with 100 – 500 employees have 15% of minimum wage workers. Small businesses with less than 20 workers employ 27% of minimum wage workers in Manitoba according to Manitoba Labour and Regulatory Services 2015 data.

Businesses effected by increases to the minimum wage are not just small businesses. Labour is a cost of doing businesses and enables business to turn a profit.

Economist Armine Yalnizyan writes in MacLean’s[xvi]:

Businesses large and small have been making the case that they can’t afford paying more for labour going back to when laws were first proposed to curb the use of seven year-olds in coal mines or put an end to 16-hour workdays.

Of course, there will be some job losses, and some smaller businesses that go under. There are always some marginal businesses for whom any higher cost—electricity or any other input, a legal dispute—will mean The End. That is genuinely heart-breaking for that business.

But small business isn’t the only beneficiary of (current) minimum wage laws.

Low wages help maximize profits. Period.

Small businesses are service industry firms like corner stores, restaurants, coffee shops, cleaning companies. When the minimum wage goes up it goes up for all competitors. They are on the same playing field and can gradually adjust prices to cover the cost. In some instances small businesses lose employees to big companies who can pay more, like Amazon going to $15/ hour in the US. Raising the minimum wage increases the playing field with larger businesses who have to compete for employees.

- What about the impact of increasing the minimum wage on non-profit organizations?

Some non-profit organizations pay workers below a $15/ hour (community living, summer students, youth workers, community development).

The work non-profits do is important yet it is under-valued. Non-profits help prevent the worse effects of poverty and support vulnerable people, yet funding does not always keep up with the rate of inflation or is short term and uncertain.

Many of the workers are female, well-educated and include racialized people. Many non-profits likely wish they could pay their workers better wages and benefits as it is ethically in line with their values. An increased minimum wage to $15 / hour would enable this.

Non-profits rely on government, foundation and fundraising for their operating dollars. Governments and other funders would need to increase funding to compensate for a $15 minimum wage. For the benefits of this increase, see 1.

- Does increasing the minimum wage cost or save government money?

Poverty minimum wage means thousands of workers rely on being paid less than $15/ hour to survive. This is costly in terms of:

Rent Assist: The provincial shelter benefit for working poor provides funding between 30% of income and 75% of Median Market Rent. A higher minimum wage would reduce costs of operating the Rent Assit program by rasing the incomes of the working poor.

Food bank use: 18% of those who rely on Winnipeg Harvest are working poor or in between jobs[xvii]. An increase in disposable income will increase the discretionary income of the poor, increase their consumer spending, and increase sales tax reveunes.

Poverty: The cost of poverty in Sasksatchewan, a province similar in many ways to Manitoba is $3.8 Billion dollars/ year. A portion of this expense is due to the impacts of poverty on the working poor: poverty impacts health and chronic diseases (diabetes, COPD, heart disease, mental health). Government will likely see reduced healthcare costs due to an increase in income for minimum wage earners.

Child poverty: children are poor because their families are poor. Manitoba consistently ranks amongst the higest rates of child poverty in Canada[xviii]. An increase in the minimum wage may contribute to reducing child poverty and the assoicted long term detrimental effects on educational and ultimately labour market outcomes, and the associated taxes paid.

- What is a fair minimum wage?

Manitoba’s minimum wage is set by policy and not based on the actual cost of living. The View from Here: Manitobans Call for a Renewed Poverty Reduction Plan finds that the minimum wage should be set at $15 per hour to lift a single parent out of poverty[xix]. This is consistent with the “$15 and Fairness” movement sweeping North America. There are several ways of calculating what a fair wage should be based on the cost of living: CCPA’s living wage is one.

CCPA developed methodology to calculate the living wage, the amount necessary for a bare bones budget for a family based on the cost of living. The living wage in 2017 was $14.54/ hour in Winnipeg, $14.55/ hour in Brandon and $15.28 in Thompson (Fernandez, Hajer and Langridge, 2017). Living wage provides important evidence for the wage necessary for a family to have a basic standard of living. The living wage, however is an optional policy for employers. Minimum wage policy sets the legal wage floor and improvements to the minimum wage would impact a large proportion of Manitobans.

10. If I go from $11.35/ hour to $15/ hour would that mean I pay more taxes? Would I be able to keep the increase?

A full time minimum wage worker would earn net approx $7,000 more / year with a $15 minimum wage. These earnings would be taxed at 10.8% for Manitoba (rate on $31,000 or less) and 15% federally (rate on $45,916 or less). The full time worker would retain $5,194 of the increase to $15/ hour. Part time workers may pay proportionally less tax than full time workers due to the Working Income Tax Benefit.

11. Why has the minimum wage not yet been increased to $15/ hour in Manitoba?

The previous NDP government increased the minimum wage every year for the 16 years they were in government (1999 – 2016) but it is still below the poverty line.

When the PCs were in power previously they only increased the minimum wage twice in eight years in office (1991-1999). (Historical Summary of Minimum Wage Rates in Manitoba)

The current PC government picked up on policy idea that has been long circulated: indexing the minimum wage to the cost of living (inflation). But the base is too low. They did not take into account the cost of meeting basic needs, which was $15.53 in 2014 dollars according to the View from Here. The minimum wage needs to be raised above the poverty line, CCPA BC office suggests 10% above to create an income buffer for low income families, and then indexed to inflation.

No-one working full time at minimum wage should live in poverty. The Minimum Wage Indexation Act, passed in 2017 legislates a poverty wage.

Fight for $15 campaigns have been successful in jurisdictions across North America for a $15 minimum wage. Fight for $15 Manitoba is the local group working for a $15 minimum wage in Manitoba; it is very important to have group advancing a $15 minimum wage in Manitoba. Make Poverty History Manitoba had a $15 minimum wage as one of six priority areas in their 2016 provincial election campaingn.

12. What about the increase to the Basic Personal Exemption?

The current Manitoba PC government and the Canadian Federation of Independent Businesses (CFIB) have advanced increases to the Basic Personal Exemption (BPE) as a way to increase disposable income for the working poor. The BPE is the tax credit so that no money earned below this amount is taxed provincially.

In reality this does very little for the working poor. As shown by a CCPA Manitoba Analysis, those at the lowest decile (lowest 10%), whose families earn 0 – $14,718 per year before taxes, save on average $17 from increasing the BPE to the national average. Those at the second lowest decile (second lowest 10% of earners making $14,719 – $21,953) will save $68. In contrast, those at the highest decile (top 10%) save $553 on their taxes. This policy allocates the vast majority of the value of the tax cut to higher income earners.

[i] https://www.policyalternatives.ca/sites/default/files/uploads/publications/Ontario%20Office/2017/07/Ontario_Needs_a_Raise_2017.pdf

[ii] https://www.policyalternatives.ca/sites/default/files/uploads/publications/Ontario%20Office/2017/07/Ontario_Needs_a_Raise_2017.pdf

[iii] https://www.policyalternatives.ca/sites/default/files/uploads/publications/Ontario%20Office/2017/07/Ontario_Needs_a_Raise_2017.pdf

[iv] Statistics Canada. Table 36-10-0222-01 Gross domestic product, expenditure-based, provincial and territorial, annual (x 1,000,000)

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610022201

[v] https://www.policyalternatives.ca/sites/default/files/uploads/publications/Manitoba%20Office/2018/06/Manitoba_Inequality_Update.pdf

[vi] https://business.financialpost.com/news/economy/ontario-minimum-wage-hike-trickles-up-to-higher-earners-over-to-other-provinces

[vii] https://www.policyalternatives.ca/publications/reports/case-increasing-minimum-wage

[viii] https://business.financialpost.com/news/economy/ontario-minimum-wage-hike-trickles-up-to-higher-earners-over-to-other-provinces

[ix] https://www.policyalternatives.ca/sites/default/files/uploads/publications/National%20Office/2014/10/Dispelling_Minimum_Wage_Mythology.pdf

[x] John Schmitt, Why Does the Minimum Wage Have No Discernible Effect on Employment?, Center for Economic and Policy Research (2013) and Dale Belman and Paul Wolfson, “The New Minimum Wage Research,” Employment Research Newsletter, Vol. 21, No. 2 (2014).

[xi] https://www.policyalternatives.ca/publications/reports/case-increasing-minimum-wage

[xii] https://www.theglobeandmail.com/opinion/alberta-hasnt-suffered-for-raising-the-minimum-wage/article37517324/

[xiii] https://www.theglobeandmail.com/opinion/alberta-hasnt-suffered-for-raising-the-minimum-wage/article37517324/

[xiv] https://www.policyalternatives.ca/publications/reports/case-increasing-minimum-wage

[xv] https://www.policyalternatives.ca/publications/reports/case-increasing-minimum-wage

[xvi] https://www.macleans.ca/economy/economicanalysis/why-a-15-minimum-wage-is-good-for-business/

[xvii] https://winnipegharvest.org/learn/winnipeg-harvest-facts-statistics/

[xviii] https://campaign2000.ca/report-cards/provincial/

[xix] . https://www.policyalternatives.ca/publications/reports/view-here-2015

By Molly McCracken

Director of CCPA-MB Manitoba