Previously published in the Winnipeg Free Press April 22, 2024

JOSH BRANDON

IN its first budget, the NDP has adhered closely to the pragmatic instincts that won them last fall’s election. The budget includes investments in health care, cuts taxes for middle income Manitobans and sets out a plan for eventually reducing the deficit.

However, the government has fallen far short in helping the lowest-income Manitobans. Budget 2024 does little to abate an escalating crisis of poverty, which directly or indirectly, touches all of us.

The record of every government may be judged by how it balances its political pragmatism with its moral courage. Governments at all levels in Canada must maintain a stable economy and appeal to swing constituencies to sustain power. These requirements limit their ability to follow their political conscience, however persistently their conscience may gnaw.

But these economic and electoral considerations are merely the bar of entry for governing. A government that focuses solely on electability loses sight of its purpose, breeds disillusionment and neglects the important causes that draw good people into politics in the first place.

The many faces of Manitoba’s crisis of poverty are well documented. Manitoba has consistently indefensible rates of child poverty. Food bank usage is up over 30 per cent compared to last year. In Winnipeg, well over 1,500 people experience homelessness. The high number of children in care and the lack of resources as they age out of that system contribute to a stubborn cycle of poverty. Manitoba’s Budget 2024 unfortunately will not reverse these trends.

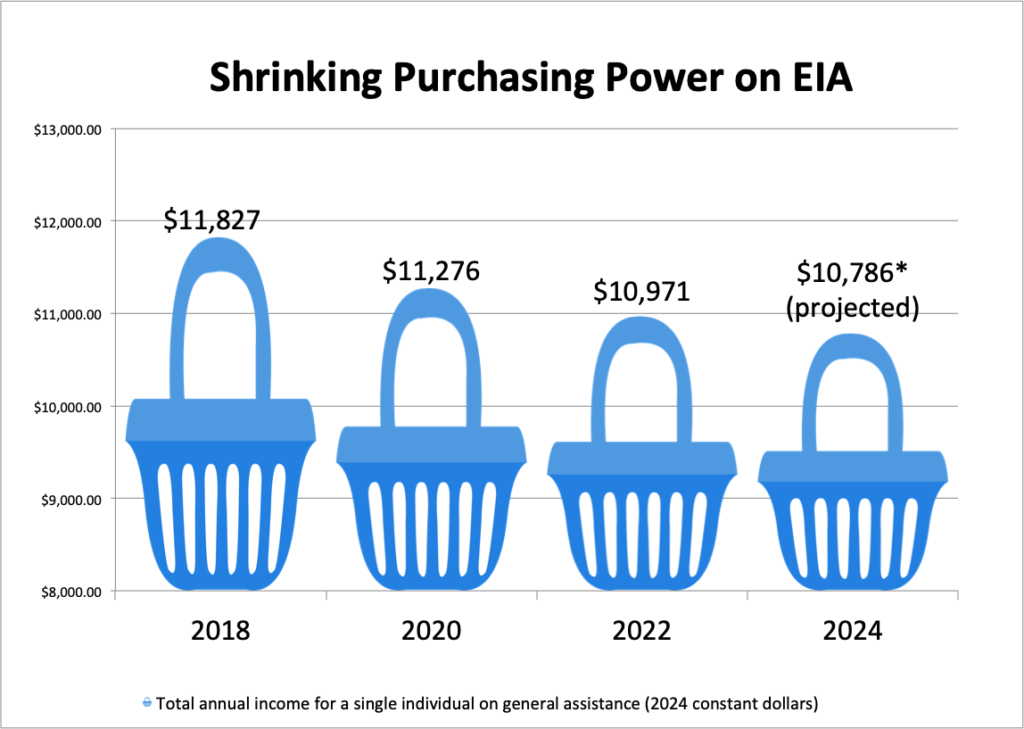

For many low-income Manitobans, including those who receive provincial social assistance, 2024 will be a year of increased deprivation. Incomes for individuals depending on Employment and Income Assistance (EIA) will drop to just $10,786 in 2024. Accounting for inflation, the real purchasing power of households on EIA has declined by $1,040, or about 10 per cent, since 2018. Without an increase in benefits, these households will be even more reliant on food banks just to survive.

There is not nearly enough funding in the budget to meet the province’s goals of ending homelessness. The Right to Housing Coalition estimates that it will cost at least $150 million per year to bring social housing up to an adequate standard. Budget 2024 only provides $78 million, up from $69 million last year, for capital upgrades and repairs. A promise for 350 new units represents only a third of what is needed annually.

Tax cuts put in place since 2016 cost over $1.6 billion per year. Budget 2024 maintains most of these, while adding a fuel tax holiday that costs $28 million per month. Almost all of these cuts disproportionately benefit wealthier and middle- income households, compared with those at the bottom of the income scale.

For example, households in the top income quintile receive more than five times the benefit of the fuel tax holiday as those in the lowest income group. The NDP’s changes to the education property tax credits (EPTC) will significantly benefit homeowners. Residences valued at $350,000 will receive the maximum $1,500 credit. Renters, who have much higher rates of housing unaffordability, will be left far behind their home-owning neighbours with only a $50 increase in their equivalent credit.

Governments’ focus on economic fundamentals is not surprising. If they are unable to secure conditions that allow businesses to accumulate profit, they risk capital flight, declining credit and rising unemployment. These have the power to blow up the economy and elected officials’ political futures in equal measure.

In this regard, Kinew applies the aphorism “the economic horse pulls the social cart.” This metaphor carries some truth, but its load is often over-weighted. Governments frequently use this as an excuse for caving too quickly to the demands of business interests, while sacrificing progress on combating inequality and funding social priorities. There is considerable latitude for progressive social action while maintaining economic stability.

Budget 2024 demonstrates that the NDP government is willing to push a little on the tractability of its economic horse. It phases out the Basic Personal Amount for very high income earners in 2025, eliminates the EPTC for businesses, and makes the residential EPTC more progressive. In sum, the NDP expects to raise an additional $122 million, while giving a net savings to median income households. The fact that the Manitoba government has received only limited pushback on these initiatives indicates that it could have gone even further.

Political calculus demands a pragmatic focus on economic growth and close catering to the wishes of middle-income voters. Lower income Manitobans lack either the economic power or the political weight to force governments to address their needs. A promised review of the province’s poverty reduction strategy may provide the government the ethical clarity it needs to place poverty reduction efforts closer to the centre of its efforts in future budgets. Meanwhile, the moral urgency of these unmet needs remains all too apparent.

Josh Brandon is a community animator with the Social Planning Council of Winnipeg and a member of the steering committee for Make Poverty History Manitoba.