by Brendan Reimer

On April 13, 2012, the Canadian Co-operative Association was informed by the Government of Canada about the termination of the Co-op Development Initiatives along with significant cuts to the Rural and Co-operatives Secretariat. This came as a surprise to the Canadian Community Economic Development Network and our member organizations including the Canadian Cooperative Association, the Canadian Worker Co-operative Federation, the Co-operative Housing Federation of Canada, the Manitoba Co-operative Association, and co-operatives throughout the country. Cuts will have a significant impact on the development of new co-operative businesses, jobs, and services for communities throughout Canada.

In a year that the United Nations has declared the “International Year of Co-operatives” — which the federal government endorsed at the United Nations and has been a partner in supporting — the elimination of the only federal government program dedicated to co-op development is not only hard to understand, it is misguided and will result in a negative economic impact much greater than the short-term spending that is “saved.”

With over $330 billion in assets, about 9,000 co-operatives in Canada provide services to 18 million members. They are a significant part of our economy and our communities. At a time when job creation is needed for economic recovery and growth, why cut support to a sector that employs over 150,000 Canadians and continues to grow? In an era when economic decisions are increasingly made outside of the communities most impacted by them, and wealth accumulates in ever fewer pockets, what we precisely need is stronger leadership and investment in a business model that roots ownership locally and distributes wealth equitably. In 2007, co-operatives in Manitoba distributed $138 million to members in patronage dividends, providing a direct economic impact for many Manitobans and for the economies in the communities that they live in.

Co-operatives usually start with a group of people looking to collectively address a need in their community, or capture an opportunity, in a way that puts their needs and their local economy first. Co-operatives build democracy through seven core principles:

- Voluntary and open membership: Co-ops are open to all persons able to use their services and willing to accept the responsibilities of membership.

- Democratic member control: Co-ops are controlled by their members.

- Members’ economic participation: Members contribute equitably to the capital of their co-operative.

- Autonomy and independence: Co-ops are autonomous, self-help organizations controlled by their members.

- Education, training, and information: Co-ops provide education and training for members, elected representatives, managers and employees so they can contribute effectively to the development of their co-operatives.

- Cooperation among co-operatives: Collaboration between co-ops benefits individual members and the co-operative movement overall by combining and sharing resources across the sector.

- Concern for community: While focusing on member needs, co-operatives work for the sustainable development of their communities.

Members participate in the election of their boards of directors, providing the opportunity for more than 100,000 Canadians to participate as volunteer directors and committee members in the governance of co-operative businesses in their communities.

Unlike traditional business models, co-operatives are businesses oriented to member service rather than the maximization of profit. This means that they will operate in circumstances that meet members’ and communities’ needs as long as economically viable. Because they are highly invested in their communities, co-ops are more likely to consider profit in terms of the local job retention, and service to community. For example, banks have closed their doors in communities across Canada because they were not earning the profits they desired. Fortunately more than 1,000 of these communities have financial co-operatives committed to serving their communities. In Manitoba, this is the case in 61 communities.

The co-operative movement’s commitment to more than the ‘bottom line’ has not compromised the viability of their business model. A 2008 study in Quebec found that 62 per cent of new co-ops are still operating after five years, compared with 35 per cent for other new businesses. After 10 years, the figures are 44 per cent and 20 per cent respectively. Similar research in BC and Alberta recently found parallel results in their provinces.

Investment in the development, start-up, and growth phases of co-operatives is beneficial because of the significant impact and returns that they generate over time. The Co-op Development Initiative (CDI) provided precisely this type of strategic investment. Since the program’s inception in 2003, more than 300 new co-ops were created with support from the CDI program, and more than 1,600 groups received advice and assistance, which might yet lead to the creation of even more co-ops. In Manitoba, since 2009, a few hundred thousand dollars invested in over 25 cooperative businesses, through technical support and small grants, has allowed businesses to start up and provide much needed services. For example, Peg City Car Co-op’s return on investment from the Co-op Development Initiative has already been significant.

The government estimates it will save some $4 million by eliminating CDI and other government supports for co-operatives. This is a drop in the bucket when compared with the significant negative impact it will have on the Canadian economy and small communities in particular.

Brendan Reimer is the Regional Coordinator for the The Canadian CED Network.

by Sarah Cooper

Although the City of St. John’s, NL, has experienced a recent economic upswing, it has found that a rising tide does not lift all boats. More and more, vulnerable people in St. John’s are finding it difficult to access housing.

St. John’s is very similar to Winnipeg in some ways. Both have had high levels of poverty, and both were for a long time in a period of economic decline. Like Winnipeg, in the 1990s St. John’s lost many of its residents when they moved to other parts of Canada seeking work or opportunity. And, like Winnipeg, St. John’s fortunes have turned around in the last few years, its population is growing, and – the downside of its success – housing its residents has become a challenge.

I recently had the opportunity to travel to St. John’s for the Canadian Housing and Renewal Association’s annual conference. One of the sessions was entitled A Rising Tide to Lift All Boats: Unprecedented prosperity, an affordable housing crunch and the making of a collaborative response in St. John’s.

It discussed the work that St. John’s has undertaken to address its housing concerns. The speakers were Shannie Duff (Deputy Mayor, City of St. John’s); Marie Ryan (Co-Chair, St. John’s Community Advisory Committee on Homelessness and former city councillor); and Victoria Belbin (CEO, Canadian Homebuilders Association Newfoundland and Labrador). These three women all identified affordable housing as an important concern for the economic and social well-being of St. John’s.

As a result of oil and mineral extraction, St. John’s economy is growing rapidly. Many Newfoundlanders have returned home from working away, and many other people have moved to St. John’s. Newfoundland and Labrador is now one of the ‘have’ provinces, but is finding that this prosperity brings its own challenges. Over the last decade, the affordability gap in St. John’s has widened, and there is a shortage of affordable housing, especially for those on the lower end of the income spectrum.

Currently in St. John’s, the vacancy rate is very low, at 1.3 per cent. Many people live in substandard housing – particularly in what Marie Ryan called “slum boarding houses” – and homelessness is a growing concern. Homeownership is increasingly outside the reach of many households, and rents are increasing as the pressure on the rental market grows.

To address its housing challenges, St. John’s has long taken advantage of the housing programs offered by the federal government. There are shelters that provide emergency housing for women and children, youth, and single adults. The City provides rental housing for lower-income households, including 168 rent geared to income units and 268 lower-end of market units (for working people who cannot afford median rents). There is a Community Advisory Board that brings together community organizations to address housing issues, and the City is in the process of transitioning to a community entity model to manage housing and homelessness funds.

The key difference between St. John’s and Winnipeg’s approaches to addressing housing and homelessness lies in the cities’ respective willingness to acknowledge and discuss the issue.

In St. John’s, there are strong networks of advocates for affordable housing who push the City and the Province to do more to address housing and homelessness. Two of these outspoken advocates are Shannie Duff, the deputy mayor, and Marie Ryan, a former city councillor.

In fact, since 2004, the City has been actively working on housing issues. It has hosted two housing forums, and established the Affordable Housing Action Committee (now renamed the Mayor’s Advisory Committee on Affordable Housing). This committee includes representatives from all levels of government as well as the non-profit and private sectors, has created a housing action plan, and has partnered with government and non-profit organizations to develop 45 new units of affordable housing in St. John’s.

St. John’s leadership extends beyond the city boundaries. At the 2010 Annual General Meeting of the Municipalities of Newfoundland and Labrador, the City of St. John’s put forward a motion to:

- Affirm that housing stability is a foundation for a prosperous and vibrant municipality. Promoting housing stability contributes significantly and tangibly to local economic and social outcomes such as employment, education, health, social integration and community safety.

- Commit to develop a municipal policy and action plan to promote affordable housing in collaboration with the federal and provincial governments, and the community based and private sectors.

- To demonstrate leadership by taking concrete, collaborative local action – and collective action through Municipalities NL, in partnership with the NL Housing & Homelessness Network – to ensure adequate affordable housing for all.

This motion recognizes the challenges that municipalities across Newfoundland and Labrador are facing, and proposes some concrete steps that municipalities can take to address these challenges.

Here in Winnipeg, it is more difficult to be optimistic about our City’s approach to housing.

Winnipeg’s vacancy rate is low at 1.1 per cent and, as in St. John’s, Winnipeg housing costs continue to rise. However, unlike in St. John’s, our City Council continues to ignore our housing crisis, choosing to defer responsibility instead of showing leadership and working collaboratively with the provincial and federal governments. The Winnipeg Housing Steering Committee has only met once a year over the last four years. Most councillors choose to ignore core needs such a housing, preferring to focus on ‘sexier’ projects like waterparks and highways to developments that haven’t yet been built.

Shannie Duff acknowledges the reality that municipalities don’t have the money required to resolve the housing problem. However, she also recognizes that in Canada, the municipal level of government is closest to the people and therefore is well-placed to address their housing needs. St. John’s is showing leadership by actively engaging in dialogue with its partners to seek solutions to the housing challenges that are ultimately a problem for all levels of government.

If only Winnipeg would do the same.

Sarah Cooper researches housing issues for the CCPA-MB office.

The Joseph Zuken Memorial Association will present Errol Black with the Joe Zuken City Activist Award in recognition of his decades of activism.

Over the years, Errol has made an enormous contribution to the struggle for social justice and union rights in Canada. Errol is one of the founders of the Manitoba office of the CCPA, and has continued to be a strong supporter of the CCPA-MB for the last 15 years. Whether as a labour economist at Brandon University, sitting on the Brandon Labour Council, working as a Brandon city councilor, or thinking, talking and writing about labour issues, Errol has been steadfast in his commitment to social justice.

Everyone at the CCPA-MB congratulates Errol. His decades of activism make him well-deserving of this recognition.

The Award will be presented to Errol at the Social Planning Council of Winnipeg AGMat 7pm on June 5, 2012.

The Canadian Centre for Policy Alternatives-Manitoba and the Social Planning Council of Winnipeg invite you to attend a forum on tax fairness.

Tax Haven in the Snow:

The demise of Canada’s progressive tax system and how to restore it

June 5, 2012

1-4pm

Carol Shields Auditorium

Millennium Library

With:

- Linda McQuaig – author and Toronto Star columnist

- Ian Hudson – University of Manitoba professor and CCPA research associate

Some of the discussion will focus on:

- What would a fairer tax system look like?

- Would a fairer tax system undermine Canada’s competitiveness?

- What should be the priorities in a campaign for tax reform?

Register by June 1, 2012, by calling 204-943-2561 or emailing info@spcw.mb.ca

To download the poster for the event visit the Social Planning Council of Winnipeg.

by Ian Hudson

According to CBC news, 45% of Canadians wait until the last week before the deadline to file their tax returns. The mad pencil sharpening, digging through receipts and online filing is unlikely to generate a great deal of goodwill towards the tax collector. Perhaps this is why the Winnipeg Free Press chose April 30th to run two anti-tax View from the West editorials from the Fraser Institute and Canadian Taxpayers Federation. The Fraser Institute claimed that Canadians paid lots of taxes, the Taxpayer Federation argued that the provincial NDP had a bad spending problem and that we should be braced for “more NDP tax increases.”

While these articles are correct in arguing that government should be accountable and that we need to know how much tax we are paying (and just who is paying them) simply totting up taxes paid without also acknowledging what we get for them would be like leaving the grocery store enraged at your bill without noticing that there was a bunch of food in your cart.

The Fraser Institute article was especially misleading on this front. It diligently added up every dime that Canadians paid the government. Yet there was no acknowledgement that the government also transfers income to Canadians. In fact, the redistributive function performed by government ensures that all Canadians meet some sort of basic standard of living.

According to Statistics Canada, in 2009, the average Canadian family of two people or more received a tidy $10,200 in transfers from all levels of government. Importantly, lower income families received more than richer ones. The average family in the bottom 20 percent of Canadian income earners received over $14,000, while the richest 20 percent got a much more modest $5,800 (1). Merely adding up taxes going to government, without including transfers from government, creates a badly misleading picture on the supposed costs of the state.

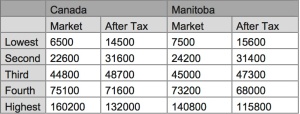

It is not overly complicated to get a picture of just who benefits from the tax and transfer system. The table below compares the income earned from “market” sources like your job and income from investments and what Statistics Canada calls after tax income, which is your market income plus the transfers that you get from government minus income tax. Note that this does not include all taxes, like sales or property tax for example, so it is not a complete measure of what government puts in, and takes out, of people’s pocket. But it does provide an illustration of how people of different incomes are affected by the government.

In both Manitoba and Canada as a whole, those in the lower income distributions receive far more in transfers than they pay in income taxes. As we go up the income ladder, the government offers less in transfers and takes more in taxes. If the government did not transfer income, or collect income taxes, the average income of the richest 20% of Canadians would have been 25 times the average income of the poorest 20%. After income tax and transfers that number is only 9 times.

The same is true for Manitoba. The average market income of the richest 20% of Manitobans is 19 times that of the poorest 20%. For after tax income, the ratio is a much more modest 7 times. So, examining only what we pay, as the Fraser Institute does, ignores the fact that the government uses some of what it takes to give back to families. Further, in its giving and taking, it creates a much more equal society. Unfortunately, it appears that this crucial role is being compromised and is not helped by editorials like those in the Free Press. One Statistics Canada study in 2009 found that after 1995, the tax and transfer system has become less redistributive, particularly due to changes in social assistance levels (2).

Of course, this calculation only includes one form of government benefit – income transfers. It excludes all of the other benefits that we receive from the government in the form of goods and services, many of which benefit all Canadians. To provide just one example, the average American family paid just over $13,000 for health insurance in 2009 (3). Canadians receive the benefit of health insurance when they pay their taxes.

In fact, government is much better suited to providing some goods and services than the current private sector provision, which would create a case for tax increases. One quick example is tree banding, which used to be provided by the City of Winnipeg. Courtesy of municipal cutbacks, tree banding on Winnipeg boulevards is now left up to the individual homeowner, a ridiculous state of affairs since just one non-banding neighbour can ruin the tree protecting efforts of the rest of the block. The principles underlying the irrationality of private provision in this simple, but familiar, case extend to many other goods and services.

Ignoring what we receive in return for our taxes ignores the fundamental tenet of tax policy, which is to tax fairly and spend wisely.

Notes

1 Statistics Canada. Government Transfers and Income Tax. http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/famil88a-eng.htm

2 Frenette, M., Green, D. and Milligan, K. “Looking for Smoking Guns: The Impact of Taxes and Transfers on Canadian Income Inequality,” p. 30.

3 Fritze, J. 2009. “Average Family Insurance Policy $13,375” USA Today, September 16. http://www.usatoday.com/money/industries/health/2009-09-15-insurance-costs_N.htm

On Friday, May 25, there will be a Celebration of Social Housing at Lord Selkirk Park.

Everyone is welcome, so please spread the word!

Turtle Island Recreation Centre

510 King Street

May 25, 11:45am

Organized by the Right to Housing Coalition, the Lord Selkirk Park Community Advisory Committee, and the Let’s Defend Our Social Housing campaign.

by Carole O’Brien and Sarah Cooper

Social housing plays an essential role in meeting housing needs for low-income households in Canada. One of the most pressing issues facing social housing providers is the imminent expiry of long-term operating agreements. These subsidies, established by the federal government from the 1950s to early 1990s, were meant to pay the debt on social housing mortgages and assist with operating deficits, covering the difference between rents paid by low-income households and operating expenses. These agreements were struck for periods between 25 and 50 years.

When the agreements were designed, it was presumed that once mortgages matured, cash flow requirements would fall and housing projects would be able to continue offering affordable rent levels without subsidies. However this has not been the case, and in 1993 the federal government began their retrenchment from social housing by transferring financial responsibility for social housing to the Provinces.

As these agreements end they are not being renewed despite increasing costs. Social housing providers have begun to experience the loss of funding as their operating agreements expire, yet poverty continues to deepen and the number of homeless people in Canada is on the rise. Social housing providers find that in the context of rising costs, maintaining low rents is near impossible.

In 2011, Steve Pomeroy prepared a report about the impending end of federal social housing subsidies. The report examined 200 agreements, covering 9000 units of social housing. Since it was not a statistical analysis, it cannot be generalized to all social housing agreements. It nevertheless raises important questions and concerns about the viability of non-profit housing providers once the agreements expire.

Pomeroy found that after the subsidies ended more than half the units reviewed would have sufficient income to cover their operating cost, but 70 percent of units would have insufficient capital reserves. Pomeroy also found that 40 per cent of the agreements (or 31 per cent of the units) would be non-viable without subsidies, while 80 per cent of the agreements would be at risk at the end of their operating agreements. In other words, without enough income to cover operating costs and/or insufficient reserves to cover capital costs, the ability of these housing providers to maintain their properties would be severely at risk.

Pomeroy states that “massive loss of existing stock is unlikely, however there remains considerable uncertainty and a not insignificant degree of risk that some properties will absolutely be lost and in other cases the number of deeply targeted units may be reduced (as providers seek to improve revenues and viability by selecting less needy tenants)” (Pomeroy 2011, 11).

Housing providers whose units are 100 percent rent-geared-to-income (RGI) are especially vulnerable when their operating agreements expire, because the rental revenues they can realistically collect are insufficient to cover the operating costs of the housing projects. This is a particular challenge for urban Aboriginal housing providers, who serve households with very low income levels and that are in need of deep RGI subsidies. The assumption underlying the operating agreements, that once mortgages were paid off projects would become viable, does not account for this reality.

Urban Aboriginal housing providers also face an additional challenge. While public housing is owned by the provinces/territories (municipalities in Ontario), Aboriginal housing is not, and is more dependent on federal subsidies. Without the financial support offered by operating agreements, and with limited rental revenues, some Aboriginal – and other – housing providers are now being forced to look at options such as selling units or moving units to market rent to create more revenue. Although this may preserve many units, it reduces the overall numbers of social housing units available, particularly for the lowest-income households.

An earlier CHRA study (2006) calculated that once all the operating agreements expire, around 2040, federal and provincial/territorial governments would economize about $3.5 billion annually. This raises questions about what to do with the dollars saved through reduced expenditures. Housing activists are also raising questions about the CMHC surplus, which was collected through housing activities in Canada. The 2006 study called for a reinvestment into housing projects experiencing viability issues, or assisting with capital replacements, since these housing assets are paid for and it would be less expensive to reinvest in them than replace them.

Given the current homelessness crisis, another use of the CMHC surplus would be to expand the affordable housing stock, especially where the need is greatest. Sharon Chisholm, former Executive Director of the Canadian Housing and Renewal Association, suggested that “[I]f the federal government were to say that it will hold the line on the existing budget, if not increase it, 80% of that budget could be used to create new housing. By the time mortgages are paid off, that could add 21,000 units of housing a year. If the provinces keep their pedal to the metal and partner, that could double” (Standing Senate Committee, 2009, p.87).

In the current political landscape, housing activists will need to redouble efforts to convince politicians to develop housing policies that reflect the real affordable housing needs of all Canadians. From maintaining units in good condition to subsidizing rents, the subsidies provided through the operating agreements provide housing for thousands of households that cannot afford market housing. Social housing is, and will always be, an essential part of Canadian cities. We must protect it.

Carole O’Brien is a student in the Master of City Planning program at the University of Manitoba and a member of the CCPA-MB board.

Sarah Cooper researches housing and community development at the CCPA-MB.

By Errol Black and Jim Silver

Formidable challenges face Canada’s labour movement. Meeting these requires organized labour to reclaim its historic role as the progressive voice of all working people, and as an active participant in broader struggles for social justice.

The Challenge

The proportion of working people who are unionized has collapsed in the U.S.A. In 2010, 12% of all U.S. workers and 7% of private sector workers were unionized. These numbers may decline further, because powerful right-wing forces in America have launched a crusade not to weaken, but to obliterate, public sector unions.

In Canada, rates of unionization remain higher than in the U.S.A. (31.2 % overall; 17.4% in the private sector), but anti-union sentiments are rampant. Right-wing governments blame union members for our economic woes, and erode the right to strike. Private sector employers demand concessions and repeatedly resort to lockouts to get them. Unions are scapegoated as outdated institutions whose demands for improved collective agreements and social legislation are an obstacle to the country’s betterment. These pressures are intensified by the erosion of manufacturing in Canada, and growing investment by anti-union entities such as the Koch brothers in oil and resource industries and Target (joining Walmart) in retail trade.

Meanwhile, those orchestrating the attacks on unions grow ever richer, while the incomes of working people decline. Between 1980 and 2009, market incomes (before taxes and transfers) of the top 20 % of income earners in Canada grew by 38.4 %, while incomes of the middle 20 % fell by 0.3 %, and incomes of the bottom 20 % fell by 11.4 %. At the same time the tax revenues needed to support the public goods that enrich working people’s lives have been eroding: in the 1960s people’s federal taxes were 25 % of corporate profits; in 2010-2011 they were 16.6 % of corporate profits. These data make clear where the real economic problem lies. They are the direct result of the neoliberal strategy imposed upon us over the past 30 years.

We Need a Different Frame

Given these economic realities, it is important to re-frame unions in a more accurate light: as leaders in efforts to build a better world for Canadians. It was trade unions and the labour movement that joined with progressive popular groups to fight for and win union and collective bargaining rights for workers, old age pensions, unemployment insurance, Medicare, the Canada Pension Plan, programs to protect the poor, decent minimum wages and employment standards, libraries, expanded access to education at all levels, workers’ compensation and workplace health and safety legislation, and the housing and infrastructure required to build decent communities for working people and their families. Not only does the union advantage produce higher wages and improved benefits for union members, but also unions bring the rule of law to the workplace, placing limits on the arbitrary power of owners and managers–thus enriching democracy and our individual and collective human r ights.

These are enormous achievements from which all Canadians benefit.

We need to be relentless in saying these things.

What is to be Done?

It is equally important for unions to act, as they have done historically, to assert their role as key players in struggles for social change, in the workplace and broader society.

In the present circumstances, these struggles must begin with defending past gains and making new ones in unions’ direct relations with employers. Because labour policy has such an important effect on workplace struggles, unions need to mobilize workers to oppose actions by governments that weaken unions, and support campaigns for legislative changes that would strengthen union rights, on the grounds that improved union rights accrue to the benefit of almost all Canadians.

It is vital also that the labour movement intensify efforts to organize the unorganized. Almost all Canadian have benefited when organizing drives have brought industrial and public sector workers into the union fold. We would all benefit if the vast numbers of precarious workers in retail trade, accommodation and food services, and other industries dependent on cheap labour were to be unionized. At the same time, of course, it is important that unions maintain quality services for members as a means of fending off challenges and raids from organizations promoting acceptance of employer demands.

As if these many challenges were not enough, unions must also expand their presence in broader struggles for social justice. This includes struggles to defeat poverty, to ensure quality housing and childcare for all, to establish a national Aboriginal strategy, and to build a productive economy. Such a presence will strengthen the campaigns for social justice and help to revitalize the labour movement.

These things, it goes without saying, are easier said than done. They require resources, skilled and dedicated organizers, and the political will and courage to act. But there are tens of thousands of young and not-so-young people eager to build a better world. They can be brought into this effort by making unions exciting places to work–places where real change happens, where bright and energetic people use their skills to take this country back from the right-wing ideologues that are destroying it.

Conclusion

To some this may sound naïve, or clichéd. It may seem to be a hollow and ritualistic call to arms, long since outdated, part of the “old thinking.”

But the idea that this is “old thinking” is simply more evidence of the success of right-wing “think tanks” and the Conservative Party and their supporters, in promoting their socially destructive ideas.

The truth is, we need to fight back. But not just that. We need to set out a vision of a better, more just world, and fight for it. Unions–as has been the case historically–have a central role to play in our doing so. To think otherwise, given the relentlessness with which the Right is pushing their regressive vision, is naïve.

by Lynne Fernandez and Errol Black

There has been much discussion about the direction Manitoba Hydro (MH) is heading in and the role it should play in our province. It’s an important discussion to have because MH is one of the most significant drivers of our economy.

As a Crown Corporation, MH wields great potential as a tool for regional development within the province and expanding the role of Manitoba in Western Canada’s economy. Substantial investment has created a competitive public utility with billions of dollars of capital assets – and great capacity for the creation of profit. This capacity makes it a constant target for privatization, a threat that persists despite assurances from those who would privatize that they have no such aspirations. Privatizing MH would have dire consequences for Manitobans, including the removal of the corporation’s ability to steer economic development through its procurement policies and training programs (tools not available to private corporations). Others point to MH’s lower than private-market rates and argue that an increase would boost profitability and convince people to conserve. However, our low rates attract businesses to the province, keep existing businesses competitive and make our province one of the most affordable places to live in Canada (the so-called “Manitoba Advantage”).

MH has played other important roles in our economic development. It has ensured that remote communities – that would not have been serviced by privately-owned power companies – have access to electric energy. Publicly-owned utilities also acted as risk taker or insurer of last resort in the development of large hydro projects – projects the private sector never would have taken on, but which now, ironically, make the corporation a target for privatization. MH also engages in leading-edge research and development. Indeed, Hydro is internationally recognized as a leader in high voltage transmission technology of the DC variety. This ability to advance new technology should drive a comprehensive regional development plan to replace fossil fuel energy.

MH does a good job of educating Manitobans about the virtues of conserving energy through its Power Smart program. In his book Build Prosperity: Energizing Manitoba’s Local Economy (2012), Shaun Loney describes how more can be done to use our energy resources more efficiently. As well, the possibility of implementing a sliding price scale that would increase with high volume use could be considered, but such a scheme would have to consider the overall economic and social objectives of the province.

Recently MH has come under fire for its medium and long-term plans to increase exports to the US. There is concern that demand for hydro power will decrease as lower-cost natural gas from fracking technology (the process of injecting high-pressure water into shale rock to extract natural gas) comes on board. The jury is still out on whether or not this new technology is going to be a major player in the energy market, particularly given environmental concerns. We are also waiting for the US economy to recover from the Great Recession so that demand for energy is restored. These developments demonstrate that future demand is impossible to predict one way or the other, but it is unlikely that demand for our energy is going to disappear. Two foreign customers (Wisconsin and Minnesota) are committed to buying energy classified as sustainable: MH’s product meets their criteria.

Another way that MH could boost demand for its product AND boost local development is to formulate a comprehensive plan for local public transportation using electric vehicles.

The province and the city are currently working on the development of a rapid transportation system for Winnipeg which, as critics have noted, is a laggard in this regard. The Vancouver Sky Train (1986), the Calgary C-Train, the Montreal Metro (1960s) and the Toronto subway are cited as examples of modern transportation systems. All of them are powered by electricity. Why are we not exploiting hydro-electric power to build and run a modern transportation system?

In fact the province is already encouraging the development of an electric bus with a recent $1 million investment in collaboration with locally-run New Flyer Industries, Mitsubishi, Manitoba Hydro and Red River College. Slated to be ready for testing one year from now, this new technology could be the basis of a comprehensive economic development initiative that would allow Winnipeg to finally realize its transportation master plan as it phases in electric buses to an expanded rapid transit system.

A modern rapid-transit system should be at the heart of our vision for future development. Indeed, one could argue that failure to develop such a system will impair, at great cost, the growth potential of both the province and our capital city.

There would be no reason to stop at buses. The province is also partnering with Red River College to develop an “electric vehicle learning and demonstration centre”. It makes perfect sense to encourage technological development in this area and to provide incentives to Manitobans to adopt electric-car technology. This demonstration centre could lead to a new program at Red River that would attract new students to the province. With MH as an active partner, Manitoba could become a hub for the development and use of new electric transportation technology and expanded generation and transmission of wind and solar energy.

Even a divided Winnipeg City Council could not deny the benefits of such a plan. Not only would Rapid Transit get the support of provincial investment in the form of new technology, it would see local industry and employment grow at the same time. By expanding in the value-added manufacturing sector, important backward and forward linkages would be established that would benefit both the private and public sectors. A bi-lateral agreement between the city and province could herald a new era of inter-governmental cooperation that would result in substantial economic, environmental and social improvements in our province. Demand for hydro power would increase, thereby raising Hydro’s profits, allowing it to keep rates low, provincial revenues high and even increase subsidies for municipal public transportation and green technology research.

Our export market will continue to have its ups and downs, whether from new technology, weather variations or the vagaries of our volatile economic system. One way of smoothing out demand is to exploit our own potential here at home: MH gives us the perfect vehicle to do just that.

Lynne Fernandez is a researcher at the CCPA-MB. Errol Black is on the board of the CCPA-MB.

Follow us!