Kevin Rebeck, of the Manitoba Federation of Labour, sent this letter to Prime Minister Stephen Harper regarding Bill C-377. This Bill would require labour organizations to submit detailed financial information covering salaries, revenues and expenses each year, to be posted on the Canada Revenue Agency website. The rationale for this bill, and its contents and implications, have not been widely reported in the mainstream print and electronic media. Rebeck’s letter to the Prime Minister identifies some of the key implications, and suggests that the Bill is yet another manifestation of the Conservative government’s contempt for working people and trade unions.

March 20, 2012

Dear Prime Minister Harper:

I’d like to draw your attention to a few of the concerns I have about Bill C-377, An Act to Amend the Income Tax Act (Labour Organizations).

As you are aware, Bill C-377 is a reflection of your contempt for the free trade union movement and not a response to an existing, verifiable issue with how unions in Canada conduct themselves.

If enacted in its current form, Bill C-377 will amend the Income Tax Act and require all labour organizations to make detailed annual financial filings covering salaries, revenues, and expenses. The information would be posted, on the Canada Revenue Agency (CRA) website, for anyone to read.

Those who drafted the Bill and its defenders argue that workers get hundreds of millions of dollars in tax benefits through union and professional dues deductions. They argue that any organization that enjoys a tax exemption should be fully transparent so that taxpayers may assess the propriety of their actions and determine whether the tax exemption is being used for the intended purposes. But C-377’s provisions only apply to unions. What about the “any organization that enjoys a tax exemption should be fully transparent” test? Why isn’t every individual, corporation and organization that benefits from tax credits, tax deductions, tax loopholes and tax reductions listed? Clearly, those aren’t the people you want to attack and union members are!

Trade unions, through existing legislative requirements and through our self-imposed constitutional requirements and every-day practices are already the most transparent entities in Canada. Our financial statements are already available to members for their inspection and, in most cases, are formally presented at membership meetings at least once a year. But this isn’t so simply because that’s the way we wrote our organizational constitutions and by-laws. It is so because that is our natural inclination. We promote straightforward, honest relations because of the strong sense of solidarity we share. We extend honesty and we expect honesty in return.

There is nothing useful to union members or the public to be gained by passing this Bill, but there is much to be gained by employers and Conservatives. Complying with its provisions will requirement substantial financial expenditures by unions – money that can be put to more rewarding uses. But that’s the whole point of the legislation now, isn’t it? You want to force unions into spending there scant budgets on meaningless, but expensive “busy work” so those financial resources can’t be spent defending union members who are attacked by their employers, filling training gaps for their members, conducting social-economic research in support of collective bargaining and maintaining a self-defense fund for use during strikes and lockouts. If you force us to use our time and resources on crap, then they can’t be used to resist your agenda.

The Bill is also a gift to employers and professional union busters. It will give them direct access to extremely detailed information about everything a union spends money on, and how strong the union they are bargaining with or have in the cross-hairs.

MP Russ Hiebert, the sponsor of the C-377, has resorted to making statements that are completely false and designed to mislead people, in an effort to justify the Bill. For example, Hansard reports that he stated, “unions already file detailed financial returns with CRA, providing much of this information”. That statement is simply untrue. He also stated, “filing would not impose any additional outside expense on labour organizations”. Again, this is not true.

In the US, where reporting requirements are not as onerous as those contained in C-377, it is estimated by the United States Office of Management and Budget that completing the forms under their legislation requires over 550 hours of work each year – the equivalent of one person working for three months to complete the task.

This level of reporting will be beyond the ability of many of our union locals and small unions to complete. They rely on volunteers to carry out their work and simply do not have the resources to do this themselves.

C-377 is an unwarranted intrusion into the internal affairs of unions in order to provide information to employers and anti-union groups while forcing unions to take on significantly increased costs.

It may well be an unconstitutional intrusion into provincial jurisdiction since labour organizations in that realm fall under provincial labour relations Acts. But we all know that your contempt extends beyond honest working people to their provincial governments as well.

In closing, let me add the following: Shame on you.

Regards,

Kevin Rebeck, President

Manitoba Federation of Labour

This weekend the federal NDP will elect a new leader. Whoever party members choose to lead the NDP should take seriously Tony Judt’s 2010 book titled Ill Fares the Land. Judt argues that our inability to stop the destructive policies of the political Right is a function of our inability to imagine a different and better way of living.

Herein lies what we believe to be the most important role for the new leader of the NDP — to change the narrative from taxes and government are bad, to a narrative that states the far reaching benefits of a more collective, egalitarian and inclusive society. A model that other countries such as Denmark, Finland, Norway and Sweden, have shown to produce better outcomes on many social and economic indicators.

If we can achieve this outcome, it would ensure promising futures for both the NDP and Canadian society.

by Errol Black and Jim Silver

It is essential that we oppose the terribly destructive policies being imposed upon us by the federal Conservative government, but it is equally if not more important that we think and talk about the kind of alternative approaches that we need.

A useful starting point in thinking alternatives is a small book by the late Tony Judt, titled Ill Fares the Land. Judt says: “Something is profoundly wrong with the way we live today. For 30 years we have made a virtue out of the pursuit of material self-interest,” out of “the obsession with wealth creation, the cult of privatization and the private sector, the growing disparities of rich and poor.” He adds: “We cannot go on living like this… We know something is wrong and there are many things we don’t like. But what can we believe in? We seem unable to conceive of alternatives.”

His view, and ours, is that what we can believe in, and what we should publicly make the case for, is a more collective and egalitarian, and a less individualistic and narrowly materialistic, approach to our way of living and our governance.

Stephen Harper and Britain’s David Cameron, and before them Margaret Thatcher and Ronald Reagan, and to our south the truly remarkable crew now contesting the Republican Presidential nomination, all believe we are better off if we assume that we are, and govern ourselves as if we were, simply and only individuals. Thatcher went so far as to say that there is no such thing as “society.” There are only individuals and their families.

Judt rejects this reasoning, arguing that the individualist pursuit of narrow self-interest, and the belief that all that matters is the relentless quest for limitless prosperity and material wealth, is destructive of the collective good, and a diminution of what it means to be fully human. It promotes an emptiness that can be filled only by the increasingly aggressive demands to consume, demands that are destroying not only our collective wellbeing, but the very earth that sustains us. This is, among other things, an ethical issue. A progressive politics ought to include an ethical vision.

Judt argues in favour of returning to the more collective and egalitarian approach to living and governing that characterized the quarter century following the Second World War. Margaret Thatcher got it wrong. Individuals and families don’t live in isolation from each other. On the contrary, we are all dependent, one upon the other, for our day-to-day subsistence and our survival as a species. Rather than the greed and growing intolerance and insecurity that are promoted by the appeal to narrow, materialistic individualism, our individual wellbeing is better ensured by developing greater levels of mutual support and solidarity, and by sharing the fruits of our collective efforts—in such a way that no one is left out. This necessitates that we build collective institutions, which in turn requires that governments invest in our collective wellbeing.

The result of governments doing so would be a move away from the truly intolerable gap that has emerged these last three decades between extreme wealth, and debilitating poverty. The growing gap between rich and poor, and the squeezing out of the middle class, is the product of the relentless promotion by the political Right of greed, and of excessive individualism and materialism. The evidence is overwhelming that more equality brings with it better health, improved educational achievement, lowered levels of violence, plus greater levels of mutual trust and security. Judt observes: “Inequality is corrosive. It rots societies from within.” It is an ethical issue. It is ethically wrong that some should be rich beyond comprehension while others barely survive. It is also an economic issue. We would all be better off if we were to reject those who urge the endless pursuit of wealth, and adopt instead policies characterized by moderation and prudence, directed not to the promotion of a narrow stratum of the obscenely wealthy, but rather to the goal of each of us and all of us having enough.

Taking this approach will require a more progressive form of taxation, and for those who are exceptionally wealthy, a steeply progressive level of taxation, in order to facilitate public investment in the collective benefit of all. Progressive taxation is a good thing. It can facilitate publicly funded and universally available social and economic services of a wide variety of kinds—health; education; pensions; infrastructure, for example. In such an environment each of us and all of us could develop our capacities and capabilities to their full potential, and apply our skills in ways that produce both individual and collective benefits.

Judt argues that our inability to stop the destructive policies of the political Right is a function of our inability to imagine a different and better way of living, and he argues that this is a discursive problem: “we simply do not know how to talk about these things any more.”

We need to talk about these things. But how do we break the Right’s narrative that both taxes and government are bad, and replace it with an alternative narrative? Judt advocates being relentless in making clear how mindless and destructive the “fantasies” offered by the Right are, and how economically and ethically flawed they are. He recommends that we be similarly relentless in talking about, and outlining fully and consistently the benefits of, a more collective and egalitarian and inclusive society. We agree, and would add that the creation of such a society is not mere “pie in the sky”: Scandinavian countries – Denmark, Finland, Norway, Sweden –consistently lead Canada, the U.S. and the U.K. on virtually all indicators of social and economic wellbeing. The superior performance in these countries reflects a strong commitment to social democratic principles and robust trade union movements. Greater equality and inclusiveness, justified for reasons as much ethical as economic, is an alternative frame that can find resonance with Canadians because it connects with Canadian values, and because it can build a better future for all of us.

Judt’s point is: let’s talk about such alternatives!

Errol Black and Jim Silver are CCPA-MB board members.

Unfortunately this year’s preliminary operating budget does not set a clear course that will help the city realize the goals stated in OurWinnipeg. Instead, it pits the private sector against the public, businesses against property owners, transit against cars, the inner city against the suburbs and the city against the province.

It doesn’t have to be this way.

Our response explains how this year’s tax increase could have been lower and how the city could be smarter in how it raises revenues. See the full report here.

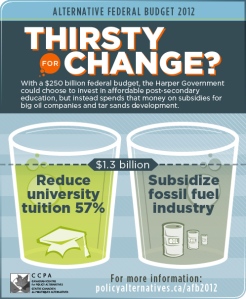

The CCPA has developed an online tool that will let you test your budgeting skills. If you were the Government of Canada, what would you choose?

Find out how well you can budget by selecting the programs you think are important to building a better Canada. But keep an eye on the graphs! Budget choices have consequences and with every program or taxation change comes an effect on the deficit and unemployment. When you think you’ve built the best budget for Canada, be sure to name your plan and hit “I think I can budget!” to share it online.

For more information on this year’s budget, check out the CCPA’s Alternative Federal Budget.

Read the full Alternative Federal Budget.

Lire l’Alternative Budgétaire Pour le Gouvernement Fédéral

by Shauna MacKinnon

As the federal government begins to reveal tidbits about what Canadians can expect in the 2012 federal budget, many of us are understandably anxious about our future. We are increasingly concerned that our children and grandchildren will not do better or even as well as we have. We wonder whether important programs and services will be available to us and our families as the government moves forward with plans to cut department budgets by 10 percent over a three-year period.

The Harper government continues to report that the economy is strong. However, this is not the reality for too many Canadians: while the latest job numbers show improvement in the job market, they fail to account for the thousands of Canadians who have lost hope and given up looking for work. They also fail to reflect the disturbingly high rate of unemployment among youth and Aboriginal people.

Income inequality continues to take on extreme dimensions. Stagnant wages for most Canadians have meant that many are taking on more debt as they try to keep up with increasing costs. It is now at a point where the Bank of Canada Governor Mark Carney has raised repeated warnings about household debt. At the same time corporate Canada continues to build its corporate cash stash from a decade of tax cuts.

by Brendan Salakoh

After two years of research and analysis, the City of Winnipeg has recently released its new official plan, Our Winnipeg. The 20-year growth strategy identifies several corridors and centres which (due to transit, location, and other factors) are ripe for intensification. However, the document, although visionary, has yet to identify specific policy and planning tools with which to encourage and implement this intensification strategy. Moreover, although there has been much written about intensification (the development of a property, site, or area at a higher density than currently exists, typically to increase population densities) in larger urban centres in Canada (such as Vancouver and Toronto), very little has been written about mid-sized, slower growth cities like Winnipeg. This paper looks at specific policy and planning tools which will enable the intensification vision to be implemented. First, it briefly touches on the benefits of urban intensification, the advantages Winnipeg has, and the challenges it faces. Second, it outlines a list of short and long term initiatives that can help Winnipeg meet its urban intensification objectives.

The Benefits of Urban Intensification

Urban intensification has several benefits related to the three branches of sustainability. Environmentally, farmland is preserved and contaminated brownfield sites can be adaptively reused. The walkability and transit efficiency that intensification promotes can also play a significant role in lowering greenhouse gas emissions. Economically, governments can increase their property tax base without having to extend new infrastructure. Furthermore, the critical mass that increasing population density creates ensures that local retail, schools and community facilities remain viable. And socially, the walkability that increased density enables can enhance mobility and improve health outcomes. Moreover, safety is increased because more “eyes on the street” at all hours help deter would-be criminals.

Current Incentives, Advantages and Potential Locations

There are currently several incentives in place that promote urban intensification, particularly in the downtown. These include tax increment financing grants to downtown residential developers, infill tax credits, a secondary suite program, and various heritage redevelopment grants and loans. Besides these incentives, there are several other factors which bode well for intensification in Winnipeg. Economically, we’ve seen rising home prices (making multi-family buildings more competitive), and the steady growth of our diverse economy. Demographically, we’ve experienced renewed population growth (primarily through immigration), and shifting preferences – students, young professionals and empty nesters are finding the “condo lifestyle” more appealing. And physically, Winnipeg is blessed with existing town centres (due to our amalgamation history) and an abundance of redevelopable heritage properties. Moreover, we were fortunate that our major arterials were untouched by freeway development, leaving potential corridors and nodes ripe for intensification.

Intensification should be targeted for areas where it is appropriate and feasible, which generally include nodes, corridors and centres. Nodes are hubs of activity, which often feature a mix of uses, several transit options, and higher densities. Examples of nodes with potential for intensification include the intersection of Dakota and St. Mary’s, as well as Confusion Corner. Corridors ripe for intensification are generally found along our major arterials – imagine Selkirk, Ellice or St. Anne’s becoming as vibrant as Osborne or Corydon in a few decades. Finally, major regional centres (like Garden City Shopping Centre or St Vital Mall) have plenty of potential for intensification – they are well served by transit, have a variety of uses within close proximity, and have plenty of developable land (temporarily being used as surface parking, of course).

What are the Challenges and Barriers to Intensification?

Despite the aforementioned advantages in Winnipeg, there are still several challenges and barriers to urban intensification in slower-growing, mid-sized cities. Economically, developers often find intensification projects less profitable – they’re riskier, harder to finance, and more expensive (due to land assembly costs and higher land prices). Housing prices are still relatively cheap, making condos or rentals less appealing to many. In terms of policy and planning, greenfield developments on the city’s fringe (where much land has been opened up for development) are almost always easier build than infill. Moreover, regulations and standards regarding street widths, turning radii, and building setbacks can also prove challenging for intensification projects in mature neighbourhoods. Politically, intensification almost always faces opposition from existing residents. Popular NIMBY worries include an increase of traffic and crime, and a decrease in property values, parking spaces, and open space. City councillors are invariably in a tough position – will they vote for a project that they personally support, but risk angering vocal residents (and voters)? Lastly, there are some physical barriers. Short commute times negate the impetus to live closer to the core; there is an abundance of developable land in every quadrant of the city; and, many Winnipeggers will always refuse to walk or bus in our extreme climate.

What are the Potential Implementation Tools?

The following section lays out potential tools that the City (and to a lesser extent, the Province) can use to promote urban intensification. These implementation tools were developed through extensive policy and literature reviews, case study analysis, and interviews with key informants (including planners, developers, politicians, and professors).

Set Clear Intensification Targets

The language of Our Winnipeg is very idealistic: It proposes to support urban design principles, encourage mixed-use development, and promote sustainability. However, these commendable goals are very vague, and lack clear implementation strategies and targets. The City should establish a set of clear targets, in terms of how and when they will meet these objectives. In Ontario, the Places to Grow Plan (the growth plan for the Greater Golden Horseshoe) is very specific in its targets – for example, it mandates that 40% of all new development must be within the built-up area by 2015. Likewise, Calgary’s Municipal Development Plan not only has specific targets (in regards to density, transit mode split, and land-use mix), but also has a system of metrics to measure and monitor progress.

Proactively Zone for Higher Densities along Corridors

Proactive zoning is the act of rezoning an existing area in terms of what is desired, rather than what exists now. Winnipeg’s planning department may find success by up-zoning along corridors and targeted centres. For example, along certain segments of major thoroughfares like Pembina Highway (the site of a future rapid transit corridor), zoning currently permits primarily low-storey buildings, strip malls with ample surface parking, and various other low density uses. If the zoning were to allow mixed-use, mid-rise residential as-of-right, a gradual transformation of the corridor could eventually take place. Developers would appreciate the certainty, as well as the time and money saved, due to the fact that they would be spared lengthy public hearings or costly rezoning processes. The concept has seen success along Edmonton’s 109th Street corridor.

Implement a System of Development Charges

Development charges are typically collected by municipalities (from developers) to help cover the offsite capital costs necessitated by the new development. Levied in various ways (e.g. per lot, per housing unit, per acreage), they often cover soft infrastructure costs as well, including community centres, libraries, parks, and fire stations. While Winnipeg does institute a system of development and servicing agreements (which are negotiated between developers and the city), they are used specifically to cover hard costs, such as onsite sewers, water and roads. However, these do not account for the full costs of extending infrastructure (especially on greenfield sites), nor the long-term costs associated with maintenance. The City of Winnipeg could implement area-specific development charges in order to promote higher density development within existing areas. On lower density developments with higher per-capita infrastructure costs, the City could require higher development charges. On intensification type developments, with higher densities, these charges could be lowered or even waived outright. The goal is not to punish developers, who play a crucial role in growth of our city, but to help level the playing field between greenfield and infill development.

Institute Parking Reforms

First, the City (through its zoning bylaw) could relax parking requirements in areas targeted for intensification (namely the centres and corridors outlined in Our Winnipeg). This approach has already been successful in the historic Exchange District, where most parking requirements have been removed (as an abundance of surface and on-street parking already exists). Second, in areas where multiple projects are proposed, the City could develop district parking structures. Prominent in Calgary, district parking features a single garage (or other parking structure) which is shared by multiple nearby buildings, thus creating economies of scale. Lastly, for major corridors and centres, the City should relegate parking to the back of buildings, rather than adjacent to the sidewalk (where it is often prominently featured). This strategy would enable buildings to front the sidewalk, which is consistent with the pedestrian friendly principles outlined in Winnipeg’s Transit Oriented Development Handbook. However, until rapid transit provides a viable alternative to the automobile, parking will remain a major factor in most intensification projects.

Establish a Regional Growth Management Plan

The idea of a growth boundary is very controversial in Winnipeg for a variety of reasons, perhaps the most important being that there is no consensus on whether or not one exists. Some argue that there is no true growth boundary, and that greenfield development faces little resistance from the City and its planning department. Others have stated that Winnipeg has a very stringent growth boundary, and that developers wanting to open up new lands face a lengthy process. Opponents of a growth boundary argue that greenfield development is what the majority of buyers want, and by limiting the market, development would flee to the municipalities that border Winnipeg. Then, not only would the city have lost development, but the tax revenues that come with it. Proponents, however, argue that low density developments on the fringes are unsustainable, due to the higher costs of servicing and infrastructure. Moreover, they create increased congestion, due to the reliance on the automobile (as the critical mass necessary for efficient transit is not present). Finally, encouraging intensification can be very challenging when an abundance of developable land is available on the fringes.

A solution would be for the Province to take on a greater role in Capital Region planning. As an example, the Province of Ontario takes an active role in regional planning, to ensure appropriate growth patterns. If there was the political will, a provincially mandated regional growth management plan would prevent leapfrog development in Winnipeg’s Capital Region. Moreover, the City could simply stop extending services and infrastructure to the fringes (or at least charge developers the true cost of these extensions), which would limit sprawl right away. In that case, what may be needed is an accompanying infrastructure strategy, where the city helps manage and guide growth through strategic capital budget investments (i.e. rapid transit corridors or sewer upgrades on infill parcels).

Mount a Public Education Engagement Campaign

Community opposition has been almost universally stated as the main barrier to intensification projects. Therefore, a City-led campaign to engage and educate the public is crucial, in order to build consensus about where, how, and to what extent intensification should take place in Winnipeg’s communities. Winnipeg could offer a “Planning Academy” similar to Edmonton’s, whereby residents learn how to engage with the planning process. The City may also want to develop a Residential Intensification Guide like that used in Hamilton, which provides “residents with general information about residential intensification, insight into how intensification projects are reviewed, and the design considerations that help to successfully incorporate intensification projects into neighbourhoods”. And while it is unreasonable to expect all residents to get behind intensification, the guide would help Winnipeggers understand the importance of intensification, give examples of different densities, and contain many visuals to dispel misconceptions. Lastly, the City of Winnipeg could engage the community at the outset of any intensification project. Rather than residents feeling alienated by “done deals”, they would work with developers and city staff to come up with appropriate proposals. Residents learn about the economic realities that projects face, while developers learn about community aspirations.

Conclusion

After examining the arguments put forth in this paper, several things should be clear. First, intensification is indeed a feasible strategy to manage Winnipeg’s continued growth. Second, Winnipeg does have several policies, planning tools, and economic incentives to promote urban intensification, although there are still several economic, policy, socio-political, and physical barriers to intensification, which must be overcome. Finally, there are several implementation tools which should be enacted in concert to achieve the maximum impact in terms of intensification. As Winnipeg continues its steady growth, intensification has the potential to play a significant role in making our city attractive, vibrant, and most importantly, sustainable.

Brendan Salakoh is a recent graduate of the University of Toronto’s Masters in Planning program, and works as a planning consultant in Winnipeg.

This letter was published, in a slightly edited form, in the March 10th edition of the Winnipeg Free Press.

Dear Mayor Sam Katz,

I was pleased to hear that you cancelled the 20 cent transit fare hike. The toll that hike would have taken on lower-income families and individuals who depend on the bus would have been severe, and would have discouraged others from taking the bus.

It’s too bad that you’ve used this as an opportunity to cancel rapid transit though. In the long run, the rapid transit plan should benefit all Winnipeggers by reducing travel times and congestion on the roads.

Here’s a suggestion: what about that $7 million that was originally dedicated for rapid transit, but then set aside for a water park? Since no one seems to want to build a water park in Winnipeg, even with a $7 million dollar subsidy, couldn’t we return that to the rapid transit budget?

And, since it’s almost double the $3.6 million dollars that the fare hike would have raised, we could also reduce transit fares by 20 cents. Seems like a win-win situation to me.

Sincerely,

Sarah Cooper

Canadian Centre for Policy Alternatives-Manitoba

by Shauna MacKinnon and Ray Silvius

Manitoba has among the highest Aboriginal populations in Canada and it is growing at a faster rate than the non-Aboriginal population. Fifteen percent of Manitobans and 10 percent of Winnipeggers identify as Aboriginal. While the majority of Aboriginal people are fully engaged in employment and/or education pursuits, statistics tell us that many Aboriginal people are not. Manitoba’s Aboriginal people are not participating in the labour force at the same rate as non-Aboriginal people and when they do, they tend to earn less. According to Census Canada 2006, in 2005, 59.2 percent of the Aboriginal population compared with 67.3 percent of the total population participated in the labour force. During this same period, the Aboriginal unemployment rate was 15.4 percent in Manitoba, almost three times the rate for the overall population. On reserve, the unemployment rate was 26 percent in 2006. Although they make up less than 13 percent of the work age population, Aboriginal people represent over 30 percent of the total unemployed in Manitoba. The median annual income for Aboriginal workers aged 15 and over was $15, 246 —63 percent of the median income of $24,194 of the overall population.

The Aboriginal population is much younger and growing at a faster rate than the non-Aboriginal population. In 2006, the median age of Manitobans was 37.8 years, compared with 23.9 for those who identified as Aboriginal. Aboriginal people are a growing source of labour yet many Aboriginal people are having difficulty accessing ‘good jobs’— those that pay well, include benefits and provide opportunity for advancement.

A 2005 study Loewen & Silver published by CCPA Manitoba showed that a Labour Market Intermediary (LMI) could be an effective model to assist job seekers access good jobs as well as assist employers interested in hiring multi-barriered, low-income individuals. That report showed that LMIs are most successful when they collaborate with community based organizations (CBOs) providing training; connect job seekers with ‘good’ jobs; provide comprehensive and ongoing supports for individuals and employers; and include the full involvement of unions in organized workplaces.

The most effective LMIs are:

- Comprehensive: offering a broad array of programming and targeted supports, including basic skills, job readiness skills, counselling, job placement, on-the-job training and on-going assistance;

- Networked: linking marginalized individuals in economically depressed regions and neighbourhoods to employers through local community-based organizations (CBOs);

- Interventionist: targeting marginalized groups, tailoring jobs and hiring and training practices to meet both client group and employer needs.

Building on this knowledge, the CCPA worked in collaboration with CBOs to explore possibilities for an LMI to meet the needs of employers and residents within the boundaries of three inner-city neighbourhoods – Centennial, West Alexander and Central Park. Given the concentration of poverty in these neighbourhoods — combined with potential employment opportunities in public sector and quasi public institutions — we wanted to determine if a neighbourhood-based LMI might be a useful approach to connecting unemployed residents with decent jobs.

Through interviews and discussions with key stakeholders and a review of existing literature, we conclude that an LMI could be an effective means of filling existing gaps, support the work of CBOs, and build stronger links between employers and multi-barriered job seekers. We also conclude that while it makes sense to situate an LMI within the boundaries described, it would make most sense to focus an LMI on specific underrepresented groups because their needs are very different. As a start, we propose an LMI be established to specifically serve Aboriginal job seekers, community based organizations serving these individuals, and employers seeking to hire Aboriginal people.

The general thrust of the model proposed by Silvius and MacKinnon (2012) in the report Making employment work: Connecting multi-barriered Manitobans to good jobs, is a model developed in collaboration with CBOS and employers. It proposes formation of an LMI led by a consortium of CBOs that provide training to Aboriginal people, employers and other stakeholders. The LMI would have dedicated personnel tasked with providing employers and job seekers with supports and cultural teachings to not only match workers with employers but to also ensure successful transition for both employer and employee. The LMI would not interfere with the good work of existing organizations but would work with them to find their graduates jobs, provide employers with a direct path to Aboriginal workers and provide ongoing support.

While the majority of Aboriginal people will successfully find employment without the need of an LMI, CBOs have found that many graduates of their programs have little or no employment history and other challenges. A successful LMI would respond to this need by:

- Building on the long established relationships between CBOs and the target population(s);

- Simplifying relationships between employers and participating service organizations;

- Simplify relationships between government and CBOs by filtering information, reporting and expectations;

- Employing personnel dedicated to managing the multiple referrals and services that any one individual may require;

- Establishing an advisory board with receptive people in a number of institutions; this includes advocates with responsibilities that go beyond human resource personnel;

- Dedicating resources to ensure that multiple organizations can offer services in areas in which they have developed expertise;

- Enshrining cooperation and non-competitiveness in the governance structure.

We explore various models in our report and conclude by describing and recommending a ‘community’ focused model. We prioritize establishing an Aboriginal-focused model however we also recognize the need for a similar model to respond to the unique needs of other groups such as multi-barriered immigrants and refugees.

Given the challenges described by participants in our study, we propose that there is a gap in service that must be filled if we are to improve the long-term employment outcomes of multi-barriered job seekers. We propose an LMI is an effective and efficient model to address this gap.

Shauna MacKinnon is the director of CCPA Manitoba. Ray Silvius is a CCPA-MB researcher.

by Errol Black

Shortly after being elected with a majority government on May 2, 2011 the Harper government began to show their contempt for the rights of Canadian workers and their organizations.

On June 16, 2011, Harper’s government legislated an end to a two-day strike of CAW members at Air Canada. This was followed on June 20 with back-to-work legislation to end a lockout at Canada Post and force CUPW back to work at a wage imposed by the government with final-offer selection arbitration to follow on other outstanding issues. On October 12, Labour Minister Lisa Raitt preempted strike action by CUPE flight attendants at Air Canada by referring the dispute to the Canada Industrial Relations Board with a directive to impose an agreement or refer the matter to arbitration. On March 8th, Lisa Raitt announced that she had taken similar steps to prevent a lockout by Air Canada of the 3,000 members of the Air Canada Pilots Association, and a strike against Air Canada by 8,600 members of the International Association of Machinists and Aerospace Workers.

In all of these cases, the Harper government claimed that their actions reflected the government’s mandate “to protect the Canadian economy and Canadian jobs.” In effect, this was a declaration that strikes by workers in the federal jurisdiction will not be tolerated by the Harper government.

A bizarre manifestation of the Harper government’s labour doctrine occurred in Brandon, Manitoba with a visit from Public Safety Minister Vic Toews in November 2011. At that time the Brandon University Faculty Association was involved in a protracted, bitter confrontation with an employer intent on crushing the union. While in Brandon, Toews met with the Brandon Sun editorial board to talk about local issues including the strike. On November 22, the Sun published a story by Keith Borkowsky titled, “Toews ‘concerned’ about ongoing professors strike.” According to the story, Toews told the editorial board that “it’s time the provincial government steps in to intervene in the Brandon University faculty strike…Toews said he has encouraged local PCs to speak out on the…strike, but has not yet spoken to Premier Greg Selinger.” In his concluding comments, Toews said he thought that allowing the strike to continue was unacceptable: “I see this strike as counterproductive to what we have been doing [at the federal level with Canada Post and Air Canada…] I have to say, I’m concerned about the inability of the participants to recognize the economic damage this can do to a small centre like Brandon.”

Yet the Harper government showed no concern for the potential economic impact of labour disputes when on January 1st, 2012, 800 United Steelworkers members at Rio Tinto Alcan’s aluminum smelter in Alma, Quebec, and 450 CAW members at a Caterpillar locomotive plant in London, Ontario, were locked out by their employer. Rio Tinto Alcan used 200 of their management employees to maintain output during their lockout and Caterpillar demanded that locked out workers take a 50 per cent cut in wages, and accept degradation of their pension plan and vacation and overtime provisions in the collective agreement. When the workers rejected that demand, Caterpillar declared that it would close the London plant and relocate to Indiana. When the federal government was asked to lean on these firms to get back to bargaining, the Harper government declined to intervene or to use their influence to encourage the Quebec and Ontario governments to step in.

The Harper government has demonstrated their utter disregard for the rights of workers. We can expect the struggle to protect workers rights will intensify in the coming years requiring increased efforts to educate the general population about the destructive effects of government policies that undermine worker and trade union rights and powers, including policies that allow foreign carte blanche takeovers, particularly by U.S. based firms, of Canadian enterprises.

We will continue to follow and document the Harper government’s record on labour issues on PolicyFix. Stay tuned.

[Postscript, March 12, 2012: Labour Minister Lisa Raitt was interviewed by Evan Solomon Saturday morning (March 10) on CBC Radio’s, The House. The interview focused on the latest intervention by Raitt into disputes between Air Canada and two of its unions, the Air Canada Pilots Association and the International Association of Machinists and Aerospace Workers of Canada. At one point in the interview, Solomon asked Raitt if the government’s apparent preoccupation with Air Canada with its dealings with unions was a result of a flaw in the bargaining process at Air Canada. In response, Raitt said “No. In fact, six separate times unions and Air Canada management have reached a deal and shook hands across the table, but then the agreements were rejected by the members. The collective bargaining process works. It seems to be the ratification process that is in dispute.” For Raitt and her government, it seems that “protecting the public and the Canadian economy” (as defined by them) trumps the rights of Air Canada workers and unions. Unfortunately, Solomon didn’t follow up on this particular point.]Errol Black is on the CCPA-MB’s board.

This compilation of stats and figures illustrates the current housing situation, particularly for lower income households, in Manitoba. Winnipeg figures are here.

References are available at the bottom of the page, in case you are looking for more details.

Core Housing Need

Definition of Core Housing Need

“Acceptable housing is defined as adequate and suitable shelter that can be obtained without spending 30 per cent or more of before-tax household income. Adequate shelter is housing that is not in need of major repair. Suitable shelter is housing that is not crowded, meaning that it has sufficient bedrooms for the size and make-up of the occupying household. The subset of households classified as living in unacceptable housing and unable to access acceptable housing is considered to be in core housing need.”(1)

Core Housing Need

In 2006:(2)

- 11.3 % of all MB households lived in core housing need (46,900 households)

- 24.0 % of MB renter households lived in core housing need (28,800 households)

- 6.2 % of MB owner households lived in core housing need (18,100 households)

- 22.3 % of those who immigrated to Canada between 2001 and 2006 lived in core housing need in Manitoba (1,600 households)

In 2006: (3)

- 8.4 % of all Brandon households lived in core housing need (1,640 households)

- 17.4 % of Brandon renter households lived in core housing need (1,220 households)

- 3.3 % of Brandon owner households lived in core housing need (420 households)

- 9.6 % of all Thompson households lived in core housing need (460 households)

- 21.5 % of Thompson renter households lived in core housing need (420 households)

- 1.4 % of Thompson owner households lived in core housing need (40 households)

- 8.3 % of all Portage la Prairie households lived in core housing need (580 households)

- 20.7 % of Portage la Prairie renter households lived in core housing need (400 households)

- 4.2 % of Portage la Prairie owner households lived in core housing need (175 households)

- Data is not available from the 2006 Census for Selkirk.

Renting in Manitoba

Current Vacancy Rates

In October, 2011, the vacancy rate was (4)

- 1.0 % in Manitoba, the lowest vacancy rate in the provinces

- 1.1 % in Winnipeg, the second-lowest among all CMAs in Canada

- 0.0 % in Thompson

- 0.6 % in Brandon

- 1.0 % in Portage la Prairie

Vacancy Rates, October 2011 (5)

Rents

In October 2011, the average rent was (6)

In 2011, the Median Market Rent in Manitoba was (7)

Affordability of Average Rents in Brandon (8) (9)

Affordability of Average Rents in Thompson (10) (11)

Affordability of Average Rents in Portage la Prairie (12) (13)

Affordability of Average Rents Compared with EIA Rental Allowances (6) (14)

Demographics

Migration

The population of Manitoba increased by 15,800 people from 2009-2010 (from 1,219,600 to 1,235,400).(15)

2010 immigration to centres in Manitoba (16)

Social Housing

Manitoba Housing “owns the Province’s housing portfolio and provides subsidies to approximately 34,900 households under various housing programs. Within the portfolio, Manitoba Housing owns 17,600 units of which 13,100 units are directly managed by Manitoba Housing and another 4,500 units are operated by non- profit/cooperative sponsor groups or property management agencies. Manitoba Housing also provides subsidy and support to approximately 17,300 households (including 4,700 personal care home beds) operated by cooperatives, Urban Native and private non-profit groups.” (17)

National Social Housing Construction

In 1993, the federal government withdrew from housing. Until then, about 10 percent of the housing built each year in Canada was affordable to lower income households; since then it has been less than one percent.(18) (19)

References

(1) CMHC 2011, Canadian Housing Observer.

(2) CMHC 2006, Canadian Housing Observer. Also offers data on types of family, Aboriginal status, and period of immigration.

(3) CMHC.2006. Census-based housing indicators and data. Housing in Canada Online.

(4) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(5) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(6) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(7) Government of Manitoba, date unknown. Housing Income Limits and Median Market Rent

(8) Statistics Canada. 2006. Profile for Census Metropolitan Areas and Census Agglomerations, 2006 Census: Brandon.

(9) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(10) Statistics Canada. 2006. Profile for Census Metropolitan Areas and Census Agglomerations, 2006 Census: Thompson.

(11) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(12)Statistics Canada. 2006. Profile for Census Metropolitan Areas and Census Agglomerations, 2006 Census: Portage la Prairie.

(13) CMHC 2011, Fall. Rental Market Report: Manitoba Highlights.

(14) Government of Manitoba. Employment and Income Assistance Facts.

(15) City of Winnipeg. 2011, May 1. Population of Winnipeg.

(16) Government of Manitoba. 2011. Manitoba Immigration Facts: 2010 Statistical Report.

(17) Manitoba Housing and Community Development. 2010. Annual Report 2009-2010.

(18) CMHC. 2011. CHS – Public Funds and National Housing Act (Social Housing).

(19) CMHC. 2011. CHS – Residential Building Activity.

Follow us!